Investors looking for high-quality businesses should consider dividend growth stocks. The beauty of strong dividend growth companies is that they pay their investors rising streams of dividend income, regardless of the direction the market is going.

Dividends provide a real return that helps cushion investors’ portfolio against falling stock prices, while giving investors a nice boost when markets are rising. Dividend stocks that increase their dividend payouts each year are even better.

For example, the Dividend Achievers are a group of 266 stocks with 10+ consecutive years of dividend increases.

This article will discuss the top 10 Dividend Achievers, ranked according to their expected returns found in the Sure Analysis Research Database.

Top Dividend Achiever No. 10:Â AmeriGas Partners

- Expected Annual Returns: 15%-16%

AmeriGas Partners (APU) is the largest propane distribution company in the United States, serving nearly 2 million customers in all 50 states through approximately 1,900 distribution locations.Propane sales account for nearly 90% of the company’s annual revenue, with related equipment and accessories accounting for the remaining 10%. AmeriGas has a market capitalization of $4.4 billion. UGI Corporation is AmeriGas’ general partner and also owns 26% of the partnership’s common units.

Fortunately, conditions should improve in 2018. The company’s two main growth catalysts are its recent cylinder exchange program, and customer account growth. AmeriGas’ growth driver is to slowly consolidate the fragmented propane distribution industry. The partnership made five bolt-on acquisitions in fiscal 2017 and more than 80 acquisitions in the last decade. Both initiatives have helped produce growth.

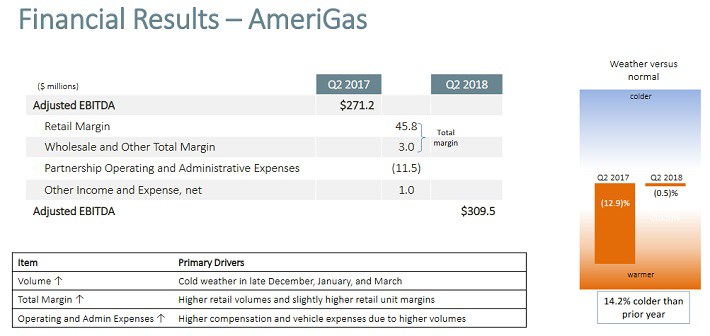

On 4/29/18, AmeriGas reported strong second-quarter results.

Source:Â Earnings Presentation, page 10

For the quarter, AmeriGas reported 14% adjusted EBITDA growth, due to 18% volume growth for its national accounts program and 15% volume growth for the cylinder exchange program. Volume growth was driven by more favorable weather conditions. Temperatures were 14% colder than in the same quarter last year, which helps boost demand for propane.

AmeriGas has taken steps to restructure its debt load over the past year, to improve its balance sheet. As a result of its refinancing actions, AmeriGas has no significant debt maturities until 2024. The company expects to have an interest coverage ratio of 3.9, using adjusted EBITDA forecasts for 2018.

AmeriGas has traded at an average distribution yield of 7.9% over the past 5 years and an average distribution yield of 7.6% over the past 10 years. The partnership’s current distribution yield of 9.3% indicates that AmeriGas is undervalued. We expect valuation changes to add 1% to annual returns going forward. In addition, we expect AmeriGas to generate 5% annual earnings growth. Combined with the 9.3% dividend yield, total returns could exceed 15% annually.

Top Dividend Achiever No. 9:Â Leggett & PlattÂ

- Expected Annual Returns: 15%-16%

Leggett & Platt (LEG) might not have an instantly-recognizable brand, but it has a great reputation among income investors. Leggett & Platt is on the list of Dividend Aristocrats, a group of 53 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

Leggett & Platt has been in business since 1883. Today, the company designs and manufactures a wide range of products, found in most homes and automobiles. Through 130 manufacturing facilities across 19 countries, Leggett & Platt manufactures bedding components, bedding industry machinery, steel wire, adjustable beds, carpet cushioning, and vehicle seat support systems.

Source:Â Investor Presentation, page 4

Leggett & Platt possesses multiple competitive advantages that are typical of Dividend Aristocrats. It has over 120 manufacturing facilities across the world. In addition, Leggett & Platt has an extensive patent portfolio, which is critical to preserving market share. It has 1,500 patents issued and nearly 1,000 registered trademarks.

Leggett & Platt’s growth will be achieved through organic expansion, as well as acquisitions. For example, in 2017 Leggett & Platt completed three small acquisitions, including a distributor and installer of Geo Components, a surface critical bent tube manufacturer to support its work furniture segment, and a producer of bonded carpet underway.

So far in 2018, Leggett & Platt acquired Precision Hydraulics Cylinders, or PHC, a leading global manufacturer of engineered hydraulic cylinders. The acquisition is expected to add 2% to overall sales growth in 2018. First-quarter revenue increased 7%, while earnings-per-share fell 8%, due to cost inflation. Still, Leggett & Platt expects at least 5% earnings-per-share growth in 2018. We believe Leggett & Platt can generate 6% annual earnings growth over the long-term.

Plus, the stock is significantly undervalued. Leggett & Platt shares trade for a price-to-earnings ratio of 15.4. In the past 10 years, the stock traded for an average price-to-earnings ratio of 19.8. As a result, we believe a return to fair value could add 5%-6% to Leggett & Platt’s annual returns. In addition to a 3.6% dividend yield, total returns could reach 15%-16% per year.

Top Dividend Achiever No. 8:Â Omega Healthcare InvestorsÂ

- Expected Annual Returns: 17%-18%

Omega Healthcare Investors (OHI) is a Real Estate Investment Trust, or REIT. REITs own real estate properties and lease those properties to tenants in select industries. Omega Healthcare owns healthcare real estate, primarily skilled nursing facilities and senior housing. The company operates ~1,000 properties in 42 U.S. states and the United Kingdom.

Source:Â 2018 Investor Presentation, page 5

The financial health of tenants is a major risk for REITs. Omega Healthcare had a difficult year in 2017, due to tenant issues. The company incurred impairment charges of $198 million in 2017 due to problems related to two tenants, most notably Orianna Health Systems.