Methodology

Our weekly best and worst reports show you stocks with the best potential returns over the coming 6 to 12 months. The score is calculated by fusing together the key drivers of price movement including, earnings beats, earnings growth, at-the-market insider buys, institutional activity, short ratio analysis, price to earnings analysis and calendar quarter seasonality. Those stocks appearing in our best list should be bought while those appearing in our worst list should be sold.

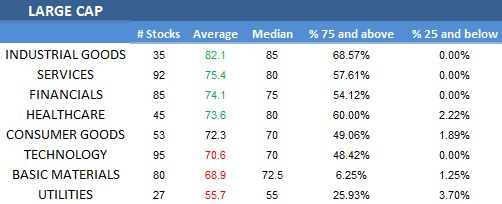

- The best large cap sector is industrial goods.

- The top large cap industry is diversified machinery.

The average score across large cap is 72.39, below the 4 week moving average score of 73.60. The typical large cap stock is trading 6.16% above its 200 day moving average, has 4.30 days to cover short and is expected to see EPS growth of 11.42% next year.

The best sectors in large cap are industrial goods, services, financials and healthcare. Consumer goods score in line. Technology, basics and utilities score below average.

Â

Â

|

|  |  |  |  |

Commentary:

The following chart shows the historical average score across large cap, by sector.

The best scoring large cap industry is diversified machinery (IR, FLS, DOV, CMI). Auto parts (LEA, JCI, MGA) offer upside on higher production. Insurance brokers (AON, MMC, WSH) benefit from rising demand tied to employment growth and pricing power. Aerospace/defense (NOC, BA, RTN, HON) benefits from rising OEM production rates and assumptions defense spending will stabilize in budget negotiations. Business software (WIT, FISV, CTSH, ADP, DOX) enjoys positive seasonality tied to expectations for rising IT spending in 2014, including a slight increase in Government IT spending. Â

In large cap basic materials, buy industrial metals & minerals (BTU, ANR, ATI), major chemicals (DOW, APD) and oil & gas drilling & exploration (CLR, NBR, RIG, ESV). In consumer goods, focus on auto parts, major food (ADM) and textiles (NKE, VFC). Across financials, the top scoring industries are insurance brokers, credit services (MCO, SLM, COF, DFS) and asset managers (AMP, TROW, PFG, BLK). The best healthcare industries are healthcare plans (CI, WLP, HUM, AET), biotechnology (CELG, GILD, LIFE) and medical instruments & supplies (BDX, SYK BCR). The top industrial goods industries are diversified machinery, aerospace/defense and industrial equipment & components (PH, EMR). In services, buy diversified entertainment (DIS, TWX, VIA), railroads (CSX, NSC, CP) and lodging (H, HOT, MAR). The best technology baskets are business software, diversified computer systems (HPQ, IBM) and technical & system software (INFY, ADSK).

Â