Top scoring weekly returns:Â Buy and Hold 1 Year

- The best sector is industrial goods

- IMPORTANT! Scores have shifted to reflect Q1 seasonality.Â

Â

The best scoring sector heading into the first quarter remains industrial goods. Consumer goods, services, and financials also score above average. In consumer, focus on mid and small cap. In financials, buy large and small cap rather than mid cap.

Â

Healthcare scores in line — focus on large cap.

Â

Technology, basics, and utilities score below average.

Â

Â

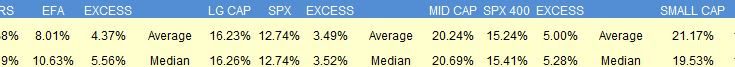

Small cap stocks produce the highest median return in the first quarter. The DJ30 has the weakest (neutral) seasonality for the period. The other major market ETFs boast solid seasonal tailwinds.

Â

Industrial Goods

Â

Industrials (XLI) have neutral seasonality for the first quarter, returning a median 4.87%.

Â

Â

The following table includes the top seasonal plays in industrials for Q1.

Â

Â

Among the top scoring industrials, residential construction (LEN, NVR) is improving and can be bought again. Aerospace (BA, CW) remains solid thanks to rising production rates. European recovery offers upside to results for machinery (TWIN, ITT) and equipment (BDC, LFUS).  Watch for an acceleration in commercial construction activity this year (MTW, TEX).

Â

Services

Â

Consumer discretionary has neutral seasonality for the first quarter, producing a median 2.03% return.Â

Â

Â

The following table shows the strongest seasonal plays in services for Q1. Restaurants (DRI, BWLD, EAT, PNRA, PZZA) are heavily represented and should be your focus early in the quarter. Retailers (ROST, SHLD, BKE, JWN, ARO, etc) also offer solid seasonality through the Q4 EPS reporting season.

Â

Top scoring services stocks are mixed across industry, with railroads (KSU, CSX, GBX), apparel stores (ANN, GCO) and restaurants (CBRL, RRGB, CAKE) well represented. Â

Â