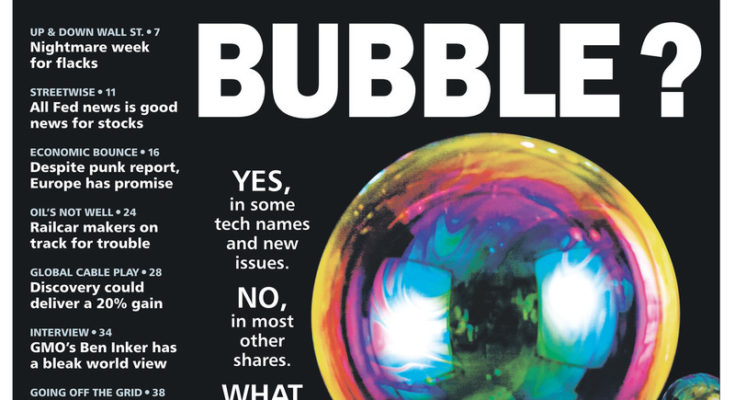

Are stocks in a bubble?

Doomsayers will argue that yes, stocks are at crazy high levels and this is another Fed-blown bubble. But Joshua Brown argues that only some stocks are in bubble territory; most aren’t:Â

“Undeniably, there are few of them – in some areas of tech and in the IPO market. Also, some credit bubbles in terms of who can get debt financed at what price. But the entire marketplace or economy is not one giant bubble, as the Prophets of Doom will have you believe. Today’s Tech and IPO bubbles are symptoms of the economic improvement this time around – people feeling good about the future – but they are not the drivers of it.” (Barron’s Gets the Bubble Meme Exactly Right)

So perhaps we’re experiencing “bubblettes” rather than one gigantic all-encompassing bubble. Barron’s agrees:Â

The widespread gains have prompted talk of a bubble similar to ones in 2000 and 2007. And in certain pockets of technology, including social media and cloud-related companies, that is no doubt true. Highfliers like Twitter (ticker: TWTR), LinkedIn (LNKD) and Workday (WDAY) all look overextended. And in the strongest IPO market since 2007, shares of up-start restaurant chains Noodles & Co. (NDLS) and Potbelly (PBPB) are rich enough to give you heartburn. (Bubble Trouble?)

According to Barron’s, blue chip stocks, including financial, technology, and energy companies, are attractive with P/E ratios in line with long-run averages. The S&P 500 is currently valued at 16 times projected 2013 operating profits and at 15 times estimated 2014. Considering the very low interest rate environment, the S&P 500’s valuation is not excessive. In addition, companies have room to further boost dividends. (Bubble Trouble?)

In other news, the countdown to the Debt Ceiling continues. The U.S. government will hit its borrowing limit on February 7, 2014. Major policy challenges are coming in January as government spending authority expires and ObamaCare continues its painful implementation.