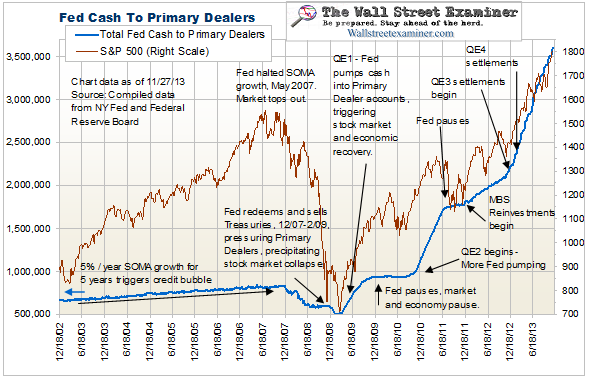

Courtesy of Lee Adler of the Wall Street Examiner

How many times have you heard the phrase that “correlation does not imply causation?†NEWS FLASH!  Correlation may not prove causation, but it can certainly imply it. And no matter that the clueless masses may repeat that phrase until they turn blue, the fact is that sometimes the correlations we see are because they do represent cause and effect. Yes, it really does happen.

Vince Foster wrote a piece over at Minyanville in which he argues:

…there is no empirical evidence that can prove Fed purchases reduce long-term interest rates or raise risk asset prices. There is only correlation. The Fed is buying bonds and bond yields are falling, therefore the Fed’s purchases of bonds is lowering bond yields. The Fed is buying bonds and stock prices are rising, therefore the Fed’s bond buying is raising stock prices. But correlation does not imply causation.

Foster is wrong. In this case, 12 years of observable data show direct correlation both short term, intermediate term and long term. In my view, that is enough circumstantial evidence for a guilty verdict in a court of law. It proves causation. It strikes me as unreasonable to look at a weekly chart of those correlations and conclude that there’s no evidence of causation.

Fed Cash To Primary Dealers – Click to enlarge

It is true that the Fed’s buying did not lower long term interest rates. The ECB’s programs did, however. The evidence for that is also overwhelming. Whenever the European crisis worsened, the ECB printed money and some of those funds were immediately deployed by the recipient banks to purchase Treasuries, driving their prices up and yields down. Whenever the European crisis subsided, and particularly since the ECB allowed repayment of LTRO funds beginning in December 2012, the carry trade was unwound and US Treasury securities prices fell.