A sometime gold-coin buyer and a frequent reader of Bankers Anonymous sent me a message a few days ago, linking to the CNBC headline “1930s-style debt defaults likely, says IMF,†and with the simple question: “Mike – True?â€

A sometime gold-coin buyer and a frequent reader of Bankers Anonymous sent me a message a few days ago, linking to the CNBC headline “1930s-style debt defaults likely, says IMF,†and with the simple question: “Mike – True?â€

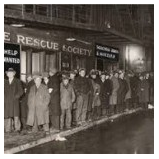

Harvard economists Carmen M. Reinhart and Kenneth S. Rogoff’s latest paper, commissioned by the IMF and published in December 2013, re-raises the specter of sovereign default in the so-called ‘developed world,’ warning of restructuring, restrictive capital controls, and debt write-offs.

Their paper was rewarded and echoed with headlines from Business Insider like “Extreme Debt Means 1930s-Style Defaults May Be Coming to Much of the Western World†and CNBC’s “1930s-style debt defaults likely, says IMF,†the headline that prompted my readers’ email to me.

This seemed like a great opportunity to reflect on the problem of different, confusing, contradictory messages constantly streaming from the Financial Infotainment Industrial Complex.

Academia, Click-bait, and Markets

Those headlines, loosely based on the Reinhart and Rogoff IMF paper, are a great example of the giant gulf between financial academia, click-bait, and actual markets. Each information source follows its own rules and logic – but mixed up together provide a cacophony of worse-than-useless dis-information.

First, academia on its own terms

Professors of international economics should consider a wide variety of scenarios, and they should present historical data, as Reinhart and Rogoff have done, with their book This Time is Different: Eight Centuries of Financial Folly.

[I confess I have not yet read this, but I suspect I will find this a useful addition to other books I have enjoyed on sovereign debt defaults, such as A Century of Debt Crises in Latin America: From Independence to The Great Depression 1820-1930 by Carlos Marichal.]

I enjoyed the Reinhart and Rogoff paper, with its useful historical data, reminding readers that sovereign debt defaults in Europe are not particularly rare. In addition, sovereign defaults sometimes come hidden in sheep’s clothing – as when a combination of capital controls, high inflation, or forced ‘savings’ from captive sources such as workers’ pensions effectively bail out overly indebted governments.