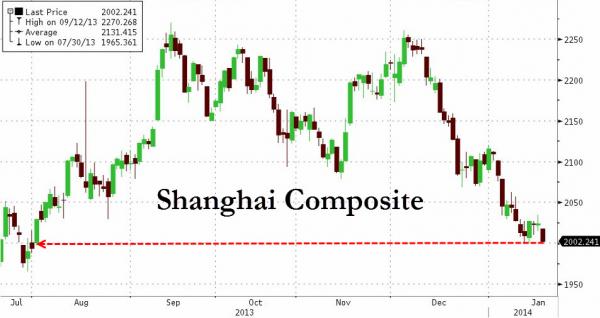

While manufacturing and services PMIs disappointed, the big problem in big China remains that of an out-of-control credit creation process that is blowing up. As we previously noted, instead of crushing credit creation, the PBOC’s liquidity rationing has forced distressed companies into high-interest-cost products in the shadow-banking world. Investors on the other side of “troubled shadow banking products” had assumed that ‘someone’ would bail them out but this evening Reuters reports that ICBC has confirmed that it will not rescue holders of the “Credit Equals Gold #1 Collective Trust Product”, due to mature Jan 31st with $492 million outstanding. The anxiety from contagion concerns of the first shadow-banking default has pushed the Shanghai Composite back near 2,000 for the first time since July – and to its narrowest spread to the S&P 500 in almost 8 years.

The Shanghai Composite is tumbling… to six month lows (and back near 2,000 for the firs time since July)…

Â

and its closest (nominally) to the S&P 500 in almost 8 years…

Â

As we previously noted

…borrowers are facing rising pressures for loan repayments in an environment of overcapacity and unprofitable investments. Unable to generate cash to service their loans, they have to turn to the shadow-banking sector for credit and avoid default. The result is an explosive growth of the size of the shadow-banking sector (now conservatively estimated to account for 20-30 percent of GDP).

Understandably, the PBOC does not look upon the shadow banking sector favorably. Since shadow-banking sector gets its short-term liquidity mainly through interbanking loans, the PBOC thought that it could put a painful squeeze on this sector through reducing liquidity. Apparently, the PBOC underestimated the effects of its measure. Largely because Chinese borrowers tend to cross-guarantee each other’s debt, squeezing even a relatively small number of borrowers could produce a cascade of default. The reaction in the credit market was thus almost instant and frightening. Borrowers facing imminent default are willing to borrow at any rate while banks with money are unwilling to loan it out no matter how attractive the terms are.

Should this situation continue, China’s real economy would suffer a nasty shock. Chain default would produce a paralyzing effect on economic activities even though there is no run on the banks. Clearly, this is not a prospect the CCP’s top leadership relishes.