The Materials sector ranks seventh out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Dangerous rating, which is based on aggregation of ratings of 11 ETFs and 15 mutual funds in the Materials sector as of January 22nd, 2014. Prior reports on the best & worst ETFs and mutual funds in every sector are here.

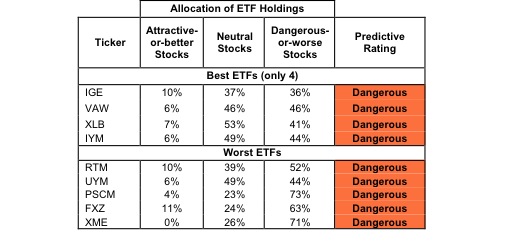

Figure 1 ranks from best to worst the nine Materials ETFs that meet our liquidity standards and Figure 2 shows the five best and worst-rated Materials mutual funds. Not all Materials sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 31 to 139), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Materials sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed predictive rating.

Investors should not buy any Materials ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Get my ratings on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

PowerShares Dynamic Basic Materials (PZY) and Fidelity MSCI Materials Index ETF (FMAT) are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.