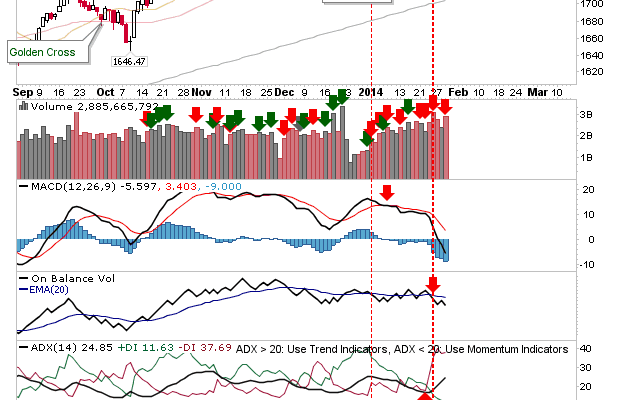

It proved to be a tough day for bulls. Shorts are unlikely to have been the cause of today’s losses, although some may not have wasted time jumping on board. Apple’s poor results were probably a cue for some long-term holders to bail out, although Fed action and international currency woes were also put forward as excuses, but collectively, this caused the nascent rally to breakdown. Volume climbed in confirmed distribution, setting up tomorrow for more of the same.

Technical weakness in the S&P intensified, although bulls will look to a third day of held support despite the 1% loss on the day. Aggressive longs could look to buy this support on Thursday with a relatively tight stop available. Again, if there is any downside follow through on today, you probably wouldn’t want to hold long into the morning session if no fightback was observed. However, a gap down at the open would be an interesting long opportunity.

Â

The Nasdaq was unable to hold its 50-day MA, although the inverse hammer/doji(?) is a more bullish candleline than might what otherwise be expected. A gap upside tomorrow morning could turn this into a ‘bullish morning star’, offering a good set up for a longer rebound.

Â

The Nasdaq 100 too is offering a nice long opportunity at channel support. Stops can go on a break of channel support.

Â

The semiconductor index has also done well to stay above its 50-day MA. This might be the best index to trade long on Thursday.

Â

The index to put the aforementioned long opportunities into jeopardy is the Russell 2000. Today, it closed below its rising channel, becoming one of the first indices to lose this crucial support level. Â It will be a tentative day tomorrow for Small Caps, as action here will confirm or deny the long side opportunity in the Nasdaq and Nasdaq 100. Those looking to buy will want to see a ‘bear trap’ where the index finishes the day back inside the boundaries of its rising channel. Â It will be a tall ask for the index, but not impossible.

Â