In spite of the recent strength in the energy sector (Brent is up around 4% this month) as well as the relative calm across major emerging markets in the past few weeks, the Russian ruble continues to slide, hitting new post-devaluation lows.

Â

|

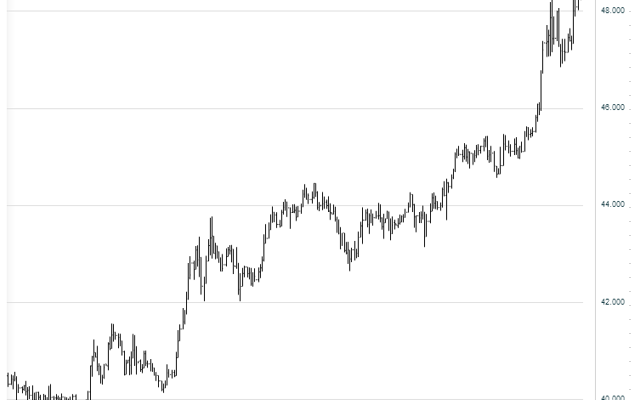

| Chart shows the euro appreciating against the ruble (source: Investing.com) |

There are several explanations for this decline:

1. The Russian economy is barely growing, with the GDP growth projection falling below that of the US.

Reuters: – Russia’s central bank said on Tuesday the country’s economic growth rate may reach the level of 1.7 to 2.0 percent in 2015-16.Â

The forecast, in a quarterly monetary policy report, implies a downward revision compared with its earlier predictions. It said in the previous quarterly report that it saw Russia’s medium-term growth potential as 2-2.5 percent.Â

The bank predicted this year’s growth at between 1.5 and 1.8 percent, down from a forecast of 2 percent made last quarter.

While such GDP projections may be OK for some developed economies, growth below 2% is a problem for a BRIC nation.

2. As discussed earlier (see post), unlike its counterparts among emerging economies, the Russian central bank has no intention of supporting the ruble. In fact many in Russia want to see the currency decline further in order to extract more rubles from the nation’s energy exports.

3. We are also seeing some spillover from the Ukrainian mess (see story). Given the ties between the two countries and the escalating tensions in the Ukraine, there is some risk that Russia could become more engaged with its neighbor. That engagement could take various forms, some of which are not palatable for the capital markets (see discussion).