China reduced its holdings of treasuries in December by the largest amount since 2011, raising some eyebrows among economists and debt investors. The sentiment among analysts is that this reduction is related to Fed’s taper, which of course doesn’t bode well for treasuries in the near-term.

Bloomberg: – “The Chinese move to sell suggests central banks are becoming more wary of taking duration risk now with the Federal Reserve firmly into the tapering process,†said Aaron Kohli, an interest-rate strategist … at BNP Paribas … “If China continues to sell again in the next month or two, than more worries will arise as to who will buy the country’s debt.â€

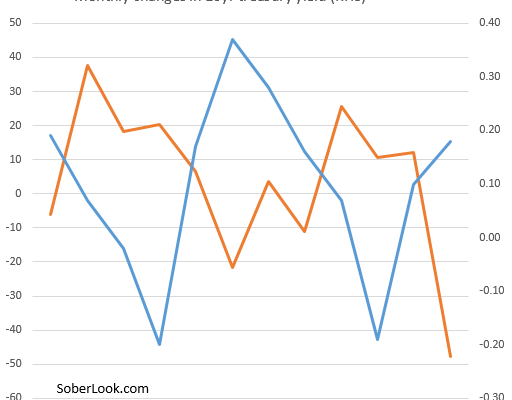

What’s interesting however is that China’s treasury position “adjustments” throughout last year seem to follow treasury prices (inverse of yields). This is akin to a retail investor buying high and selling low – chasing the market with everyone else. While analysts often assign some degree of sophistication to China’s investment strategy, the positioning in the chart below resembles a fairly incompetent trading behavior, an unsuccessful attempt to “time” the market.

Â

See if you Could Save with 21st Century

Â

|

| Source: The US Treasury |

Â