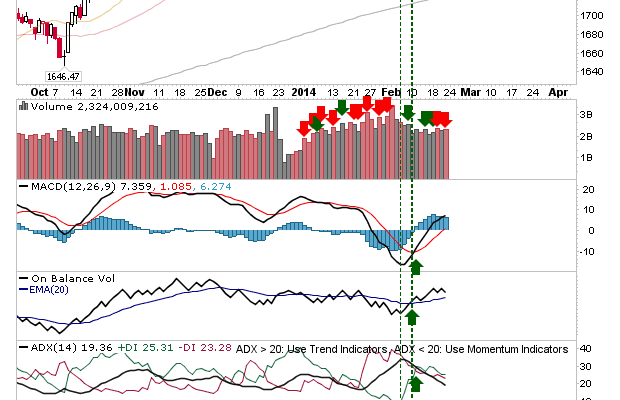

The S&P is experiencing an interesting tussle at resistance, with 1,850 proving to be a difficult level to break. Volume climbed to register yet another distribution day, but Friday’s intraday spread was narrow – offering a swing trade opportunity on break of day’s high/lows. The tightening push against resistance would suggest bulls have it, but a gap down on Monday would likely see a rapid move to the 50-day MA.Â

The loss in the Nasdaq was minor enough: Friday finished just below Thursday’s close, holding the breakout. There was a climb in volume, marking it as a distribution day, but the point loss wasn’t enough to make this a worry. Bulls may need to worry about a ‘bull trap’ – but there is lots of support to work with.

The Percentage of Nasdaq Stocks above the 50-day MA turned net bullish in technicals, while other breadth indicators are on the verge of doing likewise.

Â

The Russell 2000 gapped at resistance, and is at risk of a ‘shooting star’ if there is a gap down onMonday.The ‘bull trap’ is still in play, although Friday marked a relative gain against the Nasdaq.

The market looks like it wants to go higher so any weakness could prove a shock. If there is a gap down, it could turn into an ugly day, particularly if bulls can’t stage a recovery in the late morning.