In 2013 the six largest banks on Wall Street generated profits of $76 billion.

Last year, Wall Street’s primary self-regulatory organization FINRA imposed fines of $57 million.

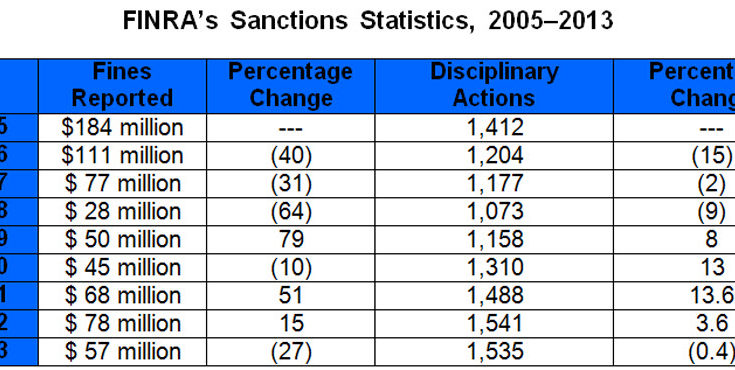

Anybody still wondering why Wall Street likes being a self-regulated industry? Is Wall Street this clean or are the regulators little more than meter maids as I have long maintained? Well, thanks to the folks at Sutherland Asbill & Brennan let’s look at the fines imposed by FINRA last year and over the last 9 years (including the years prior to FINRA’s formation in 2007 as a result of the merger of the NASD and the regulatory arm of the NYSE):

Numbers don’t lie.Â

The folks at FINRA might like to spin it that they provide a lot of data and material for their brethren at the SEC to pursue. Yet a mere few weeks ago SEC commissioner Kara Stein offered these insights in regard to the industry-funded private police, aka FINRA,

.  .  .  we must better understand and clarify the role of the FINRA, which has taken on more and more regulatory functions. In recent years, through private contracts, FINRA has come to run many critical market surveillance functions, from monitoring for insider trading, to looking for cross-market manipulations. While this may be one way to deal with increasing market complexity, it arguably has also created new challenges: including how to effectively oversee a very important, but private regulator. We need to be thinking about the interactions between FINRA and its customers, other market participants, the Commission, and regulators and participants in related markets.

$76 billion in profits for the 6 largest firms alone vs $57 million in fines across the entire industry. Those fines represent less than one tenth of one per cent of Wall Street’s bottom line.

Who is FINRA really protecting? Can you say In Bed with Wall Street?

Navigate accordingly.