In 2011 we discussed the sad state of affairs at PBGC, the government agency responsible for bailing out private pensions (see post). Back then the debate centered around the bankruptcy filing by American Airlines and the fate of its pension. Now the agency is back in the news. Today’s Bloomberg article discussed PBGC’s dealings with the 2013 Hostess failure – the maker of twinkies who shared its pension with its supplier. Needless to say the supplier’s employees went through some turbulent times.Â

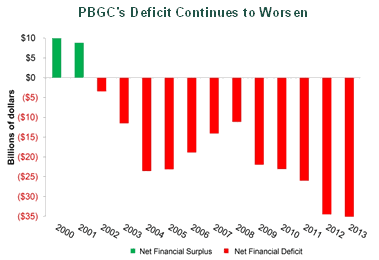

Many other sizable private pensions that pool employees of multiple companies (multiemployer plans) are also not doing so well. As PBGC takes on more failed pensions, its financial deficit – payments to pensioners offset by premiums it charges pensions – gets worse.Â

|

| Source: PBGC |

By the agency’s own admission, PBGC will be insolvent in 10-15 years as its capital base dwindles.This means that the US government will be on the hook not just for the failing public plans such as the Social Security Trust Fund, but also for some private pensions as well. Though the total failing private pension liabilities are expected to be small relative to the massive public sector problem, PBGC anticipates to see some 173 pensions fail in the next decade or so.

To avoid another federal agency bailout, three things need to happen:

1. Corporate pensions will need to pay higher premiums to PBGC.Â

2. Employees will need to contribute more to these plans on an ongoing basis.

3. Employees of bankrupt companies with underfunded pensions will need to take larger haircuts on their payouts.Â

And it will probably take all three – in addition to steady US economic expansion – in order to avoid any taxpayer involvement.