Methodology

Our weekly best and worst reports show you stocks with the best potential returns over the coming 6 to 12 months. The score is calculated by fusing together the key drivers of price movement including, earnings beats, earnings growth, at-the-market insider buys, institutional activity, short ratio analysis, price to earnings analysis and calendar quarter seasonality. Those stocks appearing in our best list should be bought while those appearing in our worst list should be sold.

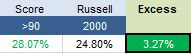

The best scoring mid caps from one year ago (2/272013) averaged 327 bps of excess over the S&P 400, with 0% turnover. The top performers include GMCR up 152%, NFLX up 145%, VRX up 117%, HBI up 93%, and UTHR up 70%.

Â

- Industrial goods are top scoring across mid cap this week.

- The best mid cap industry is residential constructionÂ

The average mid cap score is 69.14, above the four week moving average score of 66.21. The average mid cap is trading -11% below its 52 week moving average, 7.1% above its 200 dma, has 6.3 days short, and is expected to post EPS growth of 17.6% next year.

Â

The best scoring sector is industrial goods. Healthcare, consumer, financials, and technology also score above average. Services, basics, and utilities score below average.

Â