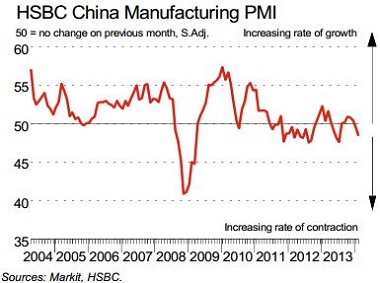

More bad news for China’s manufacturing sector as the final Markit/HSBC PMI (Purchasing mangers’ Index) reported a reading of 48.5, little changed from the preliminary (“flash”) number reported ten days ago.  This follows a disappointing reading from the official government survey yesterday. The reading for that survey, which covers large and mostly government owned companies, was just above the 50 line marking the boundary between expansion and contraction. The HSBC result, for small and mid-sized privately owned companies, was not so equivocal with a reading clearly indicating contraction.

Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC, commented on the new data:

“The final reading of the HSBC China Manufacturing PMI confirmed the weakness of manufacturing growth. Signs become clear that the risks to GDP growth are tilting to the downside. This calls for policy fine-tuning measures to stabilise market expectations and steady the pace of growth in the coming quarters.”

A significant factor in February was the occurrence of the Chinese New Year holiday for which HSBC said adjustments were made. Whether the seasonality adjustments for February might have underestimated the effect of the holiday celebration may be inferred when the March survey results are announced.

Here is the summary from the Markit press release: