Goldman’s February Final Global Leading Index places the global industrial cycle in the “Slowdown” phase, with positive but decreasing Momentum indicating a soft-patch in global growth. The infamous Swirlogram has now shifted to a more negative stance than a year ago as 8 of the 10 factors worsened in Feb. Goldman remains unapologetically optimistic that this is ‘weather’-related but we do note that the weakness is global in nature. In the US, despite beats in ‘select’ data, the US macro surprise index has started the year with its biggest fall since 2008.

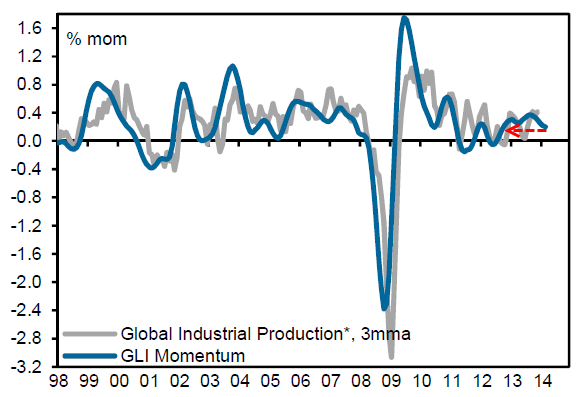

Goldman’s Swirlogram has shifted notably to the lower left (from slowdown to contraction) in the past year… as GLI momentum has faded notably year-over-year…

Only two of the ten underlying components improved in February. On the positive side, the Global PMI aggregate increased after last month’s drop, and the Japan Inventory/Sales ratio also showed significant improvement.

On the negative side, the S&P GSCI Industrial Metals Index® fell marginally and US Initial Jobless claims ticked up slightly. The Belgian and Netherlands Manufacturing Survey and the Baltic Dry Index were also softer. The Consumer Confidence aggregate, which climbed back to its highest level in six years last month, retreated marginally, while the Global New Orders less Inventories (NOIN) aggregate continued to decline, driven in part by strong inventory accumulation in the US. Finally, Korean exports were again a bit weaker but at decent levels, and the AUD & CAD TWI aggregate was only slightly lower after a sharp fall over the previous three months.

And if the belief that the US will decouple from global weakness is still alive…

US macro has worst start to the year since 2008…

Â