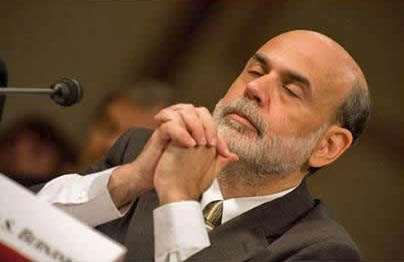

Now that Ben Bernanke is no longer the head of the Fed, he can finally tell the truth about what caused the financial crash. At least that’s what a packed auditorium of over 1000 people as part of the financial conference staged by National Bank of Abu Dhabi, the UAE’s largest bank, was hoping for earlier today when they paid an exorbitant amount of money to hear the former chairman talk.

Bernanke confirmed as much when he said he could now speak more freely about the crisis than he could while at the Fed – “I can say whatever I want.”

So what was the reason, according to the man who was easily the most powerful person in the world for nearly a decade?

Ready?

“Overconfidence.” (no, not “weather”)

Yup. That’s it.

The United States became “overconfident”, he said of the period before the September 2008 collapse of U.S. investment bank Lehman Brothers. That triggered a crash from which parts of the world, including the U.S. economy, have not fully recovered.

“This is going to sound very obvious but the first thing we learned is that the U.S. is not invulnerable to financial crises,” Bernanke said.

Actually what is going to sound even more obvious, is that subprime was not contained.

But going back to Bernanke’s explanation, brought to us by Reuters, we wonder: did he perhaps get into the reason for the overconfidence? Maybe such as the Fed’s endless hubris in believing it knew what it was doing, when time after time and especially over the past 30 years, the US central bank has shown that all it now does is lead the nation from bubble to bubble, from crisis to crisis, and replaces one asset bubble, first the dot com, then the housing, with another, even bigger one, until we get to the biggest bubble of all time – the stock market as you see it currently, where the S&P 500 soars to all time highs and when news of an ICBM launch can barely cause a dent in a ridiculous upward ramp driven by, you guessed it, overconfidence.