European sovereign bond spreads have not batted an eyelid during the recent Russia-Ukraine crisis… and why should they, Draghi will do “whatever it takes.” Even HY credit in Europe is holding up – despite an ugly squeeze wider on Friday (chatter that positioning in very long credit). But with Europe’s VIX above 20, the broad European stock index is now below pre-Putin levels. What is perhaps most stunning is that while investors have piled out of German, Swiss, and French stocks in the last few days, they have backed-up-the-truck in “new normal” safe-haven Portugal. The reason proferred by some – Portugal is further from Ukraine (and less dependent on Russia’s gas) – which of course is the critical swing factor for an economy that remains crushed aside from trade with Germany.

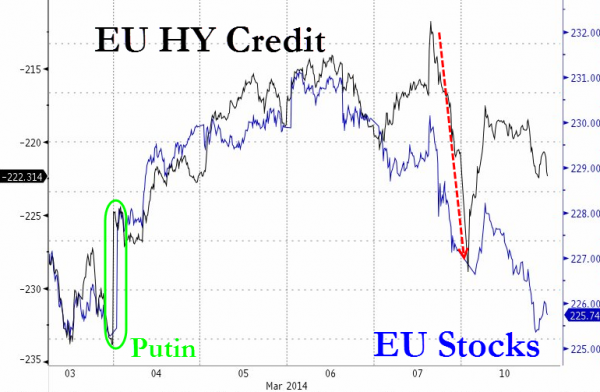

Stocks are back below Putin levels…

As investors have flushed their core German stock holdings and bid Portugal (and Italy) to the moon…

Which just exacerbates the remarkable divergence among European stocks this year…

We are sure somewhere this all makes sense…It would appear the ‘safe-haven’ seekers have forgotten that if Germany comes under pressure from Russian sanction retaliation then Europe is in trouble… but hey, why worry, just buy the worst…

Charts: Bloomberg