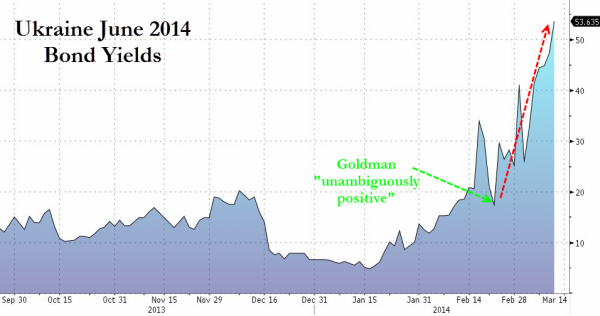

Despite promises by the West to do “whatever it takes” and Treasury Secretary Lew’s note today that Ukraine aid could reach $15 billion, it appears the market is not buying it with June 2014 Ukraine government bond yields spiking above 53% today. Of course, this should be no surprise to Goldman Sachs clients who were told on Feb 21st that events were “unambiguously positive” for short-term bonds (then trading above 97) but are now trading below 90. It seems that the market believes default is highly likely and that any “aid” will flow directly to Russia for energy bills.

Keep talking…

- *LEW SAYS UKRAINE NEEDS `FOUNDATION’ FOR ECONOMY FROM IMF

- *LEW SAYS IMF UKRAINE PACKAGE MAY BE $15 BLN OR LARGER

But the market is not buying it…

And from Goldman on Feb 23rd…

In our view, U.S. and EU financial support is likely to arrive quickly and in large enough volume to prevent a sovereign credit event from taking place in the short term. In this instance, we think that political considerations are likely to override economic or financial ones.

…

From a market perspective, we think that recent developments are unambiguously positive for short-dated credit and we would expect the yield curve to reverse its inversion.

Oops! Yields were sub 20% then… now they are 53%!