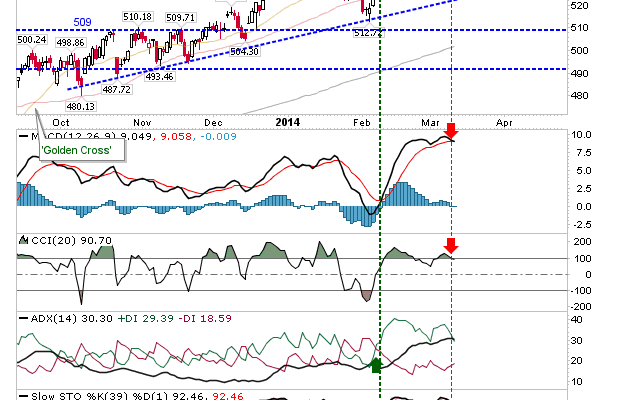

Better stuff from bulls as traders mounted defenses of support. The semiconductor had the best of the action, its large bullish engulfing pattern off the 20-day MA keeps with the story of an accelerating trend. It’s not totally out of the woods: the MACD trigger and CCI ‘sell’ suggest this rapid advance will consolidate soon, although bulls are likely to maintain the long term advantage.

The Nasdaq was able to defend its 20-day MA with a bullish piercing pattern. Technicals are mixed, but price action points to a bullish consolidation which is likely to lead to new highs. Strength in semiconductors will help the Nasdaq and Nasdaq 100.

Nasdaq Breadth has started to peak with ‘sell’ triggers in breadth metrics and supporting technicals, even the Summation Index has begun to turn.

The S&P also managed a positive test of its 20-day MA. Technicals remain bullish, although today did rank as distribution. Bulls can look to buy a break of Wednesday’s highs.Â

The Russell 2000 managed a picture perfect defense of 1,180. It will be important the bounce makes it past 1,205 in quick order, otherwise, a gentle rollover could see this index looking again at 1,180 in a couple of weeks. The drop in relative strength highlights the shift in trend in favour of more defensive Large Cap issues.Â

Thursday offers an opportunity for some upside follow through. Supply may quickly emerge, but there is some wiggle room for additional gains before then.