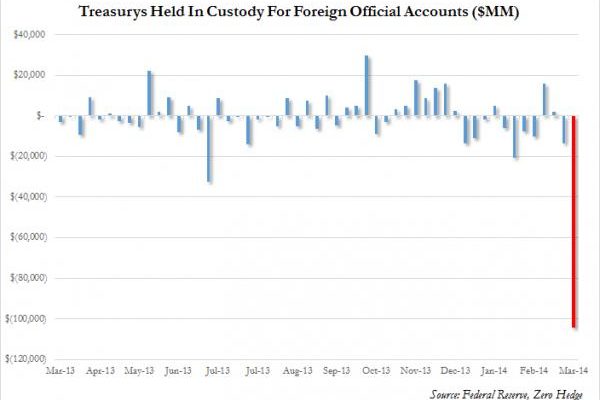

A month ago we reported that according to much delayed TIC data, China had just dumped the second-largest amount of US Treasurys in history. The problem, of course, with this data is that it is stale and very backward looking. For a much better, and up to date, indicator of what foreigners are doing with US Treasurys in near real time, the bond watchers keep track of a less known data series, called “Treasury Securities Held in Custody for Foreign Official and International Accounts” which as the name implies shows what foreigners are doing with their Treasury securities held in custody by the Fed on a weekly basis. So here it goes: in the just reported latest data, for the week ended March 12, Treasurys held in custody by the Fed dropped to $2.855 trillion: a drop of $104.5 billion. This was the biggest drop of Treasurys held by the Fed on record, i.e., foreigners were really busy selling.

This brings the total Treasury holdings in custody at the Fed to levels not seen since December 2012, a period during which the Fed alone has monetized well over $1 trillion in US paper.

So is this the proverbial beginning of foreign dumping of US paper? Could Russia simply have designated a different custodian of its holdings? No, because as of most recently it owned $139 billion in US paper, or well above the number “sold” and a custodial reallocation would mean all holdings are moved, not just a portion. For another view, here is what the bond experts at Stone McCarthy had to say:

We don’t have a ready explanation for the plunge in custody account holdings. One thing that is striking about the drop is that the last several days was not a period of heavy market buzz about “central bank selling” of Treasuries, at least to the best of our knowledge. China and Japan are by far the largest holders of Treasuries, with holdings of $1.269 trillion and $1.183 trillion in holdings at the end of December, respectively. China’s holdings are more skewed to central bank holdings. Selling of Treasuries would appear to be at odds with China’s recent effort to depreciate its currency, although on March 5 and 6 there was a brief correction in that trend.