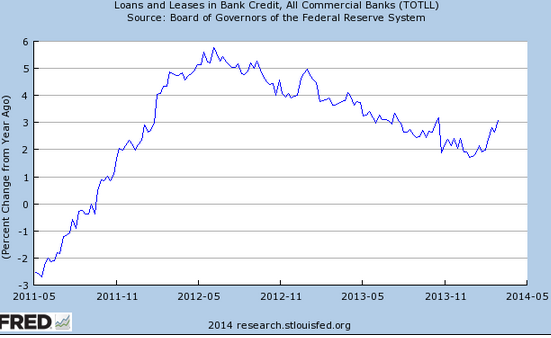

Credit growth in the US seems to have stabilized and may be on the rise. It’s worth mentioning that the bottom in loan growth just happened to correspond to the start of Fed’s taper. Coincidence?

Â

|

| Total loan growth rate YoY |

Whatever the case, this may be a sign of improving demand for credit and banks’ willingness to accommodate. The key to this change in trend is that improvements in loan growth have been primarily driven by a sudden jump in corporate lending.

Â

|

| Corporate loan growth rate YoY |

Â

Why is corporate America increasing its borrowing all of a sudden? The most likely answer is the improvement in capital expenditures – as evidenced by firmer capital goods spending by companies. We saw initial signs of that improvement back in February (see story). There were other indications as well. ISI’s latest corporate survey provides further support to this thesis.

ISI Research: – Survey strengthened over the past two weeks with U.S. orders now a solid 61.5. Areas of strength include equipment tied to trucks, rail, aerospace, and construction.

Whether using their massive cash reserves or tapping bank credit facilities (increasing bank loan balances), the time has come for higher capital expenditures by US companies. Here is why.

Barron’s: – Capital expenditures [have been] just 46% of operating cash flow for nonfinancial companies in the S&P 500. The average since 1989 is 57%. Capex can’t remain low forever. Already, the average age of U.S. structures is the highest it has been since 1964. Equipment hasn’t been this old since 1995, and intellectual-property products, like software, since 1983. In a report issued this past week, Bank of America Merrill Lynch predicts U.S. capex growth will more than double over two years, to 5.7% in 2015, from 2.6% last year. Beyond mounting cash and aging plants and equipment, it cites some new factors. Economic growth is picking up, giving business managers more confidence and less spare capacity. Congress even passed a budget this year—one less thing for business leaders to worry about.