While we realize that the world has long since stopped caring about trivial things like macro events or newsflow, it probably should be noted that while everyone was either sleeping or awaiting to see what the US response to the Crimean referendum would be, it should be highlighted that inflation in Europe just tumbled once again to a fresh retest of 4 year low levels. According to Eurostat, final February inflation was lower than the flash reading, and printed at 0.8% for the Eurozone and 0.7% for the Euroarea, down from 0.9% and 0.8% respectively. This is back to the October level when the ECB decided to cut its interest rate to a record low of 0.25% in its November meeting. As Reuters noted, inflation has not dropped below that level since November 2009, when it stood at 0.5 percent, Eurostat said.

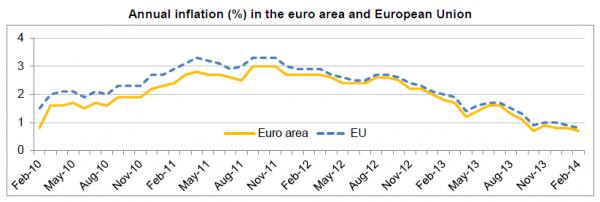

This is how European inflation, or lack thereof, has looked in the past four years:

Yet any one expecting an immediate response by Draghi may be disappointed: Bloomberg adds that the CPI reading is unlikely to immediately alter the monetary policy stance of the ECB. It fails to create a fresh cyclical low with the reading of October also having come in at 0.7 percent. The core reading remained unchanged at 1 percent.

Others agreed. From Reuters noted:

“The downward revision to the February inflation figures is unlikely to be enough to trigger further near-term monetary easing,” said Martin van Vliet, senior economist at ING. “This will also require a deterioration of the activity and or a further significant strengthening of the euro.”

A strong euro has weighed on prices, and the currency fell in reaction to Monday’s data, dipping against the dollar and paring gains against the yen.

Month-on-month inflation was 0.3 percent in February, driven by a 0.5 percent rise in prices of services and a 0.4 percent increase in costs of non-energy industrial goods.

Prices of food, alcohol and tobacco fell 0.1 percent on the month, while highly volatile energy costs inched up 0.1 percent.

In February, there were four euro zone countries with negative annual inflation rates, Portugal and Slovakia both with -0.1 percent, Greece with -0.9 percent and Cyprus at -1.3 percent.

“Today’s CPI figures are a clear reminder that low inflation may have become the new normal for the euro zone – which certainly won’t make it easy for some countries to reduce their debt overhangs,” van Vliet said.