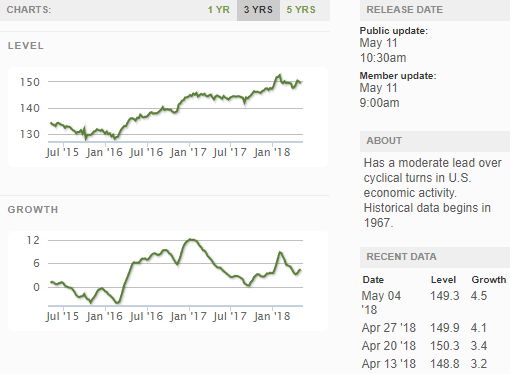

ECRI’s WLI Growth Index again improved marginally, and remains in positive territory. A positive number predicts positive growth to come within the next six months. ECRI also released their coincident and lagging indices this week and are discussed below – and both are clearly degrading.

Follow up:

Â

Current ECRI WLI Level and Growth Index

Please read The U.S. Business Cycle in the Context of the Yo-Yo Years which is an update on ECRI’s recession call.

Here is this weeks update on ECRI’s Weekly Leading Index (note – a positive number indicates growth):

ECRI WLI Ticks Down

Growth in a weekly leading index designed to forecast U.S. economic activity is gaining strength.

According to the Economic Cycle Research Institute, its weekly leading index grew 2.3% in the week ended March 14, up from 2.1% in the previous week. The upturn follows a sharp slowdown in growth during late January and February.

The index itself, however, fell to 132.9 from 133.6. ECRI says occasionally the index level and growth rate “can move in different directions, because the latter is derived from a four-week moving average.”

The February index growth rate fell sharply to 1.6% from 4.0% in January.

ECRI produces a monthly issued Coincident index. The March update for February shows the rate of economic growth declining marginally AGAIN month-to-month – and is showing a clear decline in the rate of growth trend line. The current values:

U.S. Coincident Index

/images/z ecri_coin.png

ECRI produces a monthly inflation index – a positive number shows decreasing inflation pressure.

U.S. Future Inflation Gauge

/images/z ecri_infl.PNG

ECRI Inflation Gauge Rises to 104.1 in February

U.S. inflationary pressures were lower in , as the U.S. future inflation gauge climbed to 104.1 from the revised January 102.1 reading, according to data released Friday morning by the Economic Cycle Research Institute. The January reading was initially reported as 101.4.

“Despite its recent uptick, the USFIG remains below its earlier highs,” ECRI Chief Operations Officer Lakshman Achuthan said in a release, “Thus, underlying inflation pressures are still in check.”