The good news is, the bulls halted the pullback started two weeks ago. Â The bad news is, once we hit record highs on Friday, the bears pulled the rug out from underneath the rally. Â Although all the major indices ended last week with a gain, they also ended last week pointed in the wrong direction.Â

Yes, once again stocks are caught between a rock and a hard place, and traders aren’t sure what they want to do. Â There are plenty of pending clues that will tell us the market’s true nature, however. Â We’ll explore the bullish and the bearish arguments in a moment, right after exploring last week’s major economic data.

Economic Calendar

Though we heard a lot of economic numbers last week, truth be told, not a lot of it meant much for the market.

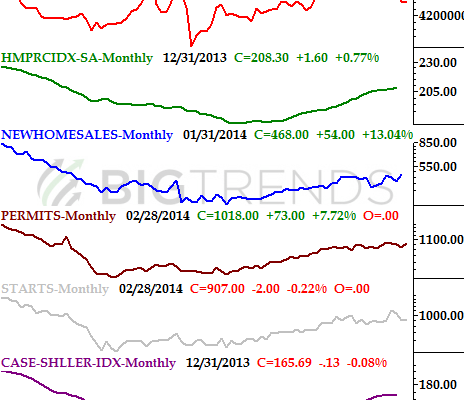

One of the more important sets of updates we got was on the real estate front… housing starts, building permits, and existing home sales.  Between the three, we got something of a mixed message.  Housing starts were basically flat, falling from a rate of 909K to 907K, while building permits grew from 945K to 1018K for February.  As for existing house sales, February’s pace of 4.6 million was just a tad slower than January’s pace of 4.62 million.Â

The data we need to fully update the chart of real estate and construction activity below will be posted next week, but even without that data we can see that the real estate market remains merely mediocre.Â

Real Estate & Construction Trends Chart

Source: Â U.S. Census Bureau and the National Association of Realtors

The only other data we got last week that was of any real consequence was the Fed’s capacity utilization and industrial productivity measure, for February.  These number were a little more encouraging than the real estate numbers were, though, at least for long-term investors who are truly only holding stocks based on the ongoing cyclical economic expansion.  The nation is now using 78.8% of its ability to produce manufactured goods, up from January’s 78.5%, while February’s industrial productivity grew by 0.6%; the industrial productivity index reached 106.6… the highest level it’s ever been.Â