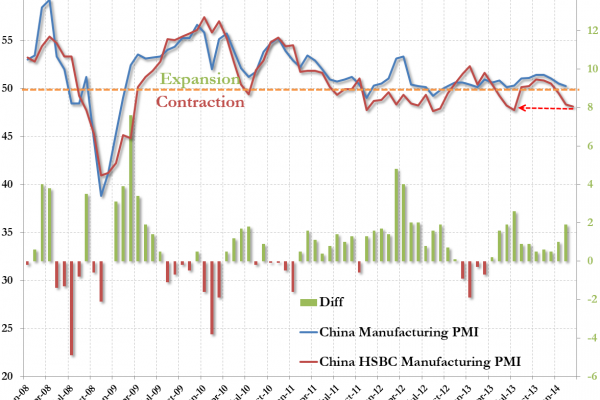

HSBC’s Flash China Manufacturing PMI printed at 48.1 (against a hope-strewn 48.7 bounce expectation). This is the lowest in 8 months and among the lowest prints since Lehman. Even the usually silver-lining-seeing HSBC Chief economist had little positive to add, “weakness is broad-based with domestic demand softening further.” Early strength in CNY, stocks, and copper is eroding fast.

Â

Across the board ugly…

And in chart format:

From Markit/HSBC: “The HSBC Flash China Manufacturing PMI reading for March suggests that China’s growth momentum continued to slow down. Weakness is broadly-based with domestic demand softening further. We expect Beijing to launch a series of policy measures to stabilize growth. Likely options include lowering entry barriers for private investment, targeted spending on subways, aircleaning and public housing, and guiding lending rates lower.â€

Too bad Beijing overnight made it quite clear not to expect any big stimulus this year…

Copper was holding in early but is fading fast now…

The Yuan rallied out of the gate on a modestly higher fixing but is fading back fast post PMI…

And for everyone hoping that bad news is good news and stimulus is coming…

*CHINA MUST FACE `MORAL HAZARD’ ISSUE, VICE MINISTER SAYS: CNBC