FX Traders’ weekly EURUSD fundamental & technical picture, this week’s market drivers that could change it- the bullish, the bearish and likely EURUSD direction.

The following is a partial summary of the conclusions from the fxempire.com weekly analysts’ meeting in which we cover outlooks for the major pairs for the coming week and beyond.

Summary

- Technical Outlook: Near term neutral, longer term bullish

- Fundamental Outlook: Neutral Near Term, Bearish Longer Term

- Trader Positioning: Reminiscent Of The Last Big EURUSD Pullback Per Two Surveys

- Conclusions: Some potentially potent drivers, however the big moves likely not until the following weeks & Why

TECHNICAL OUTLOOK

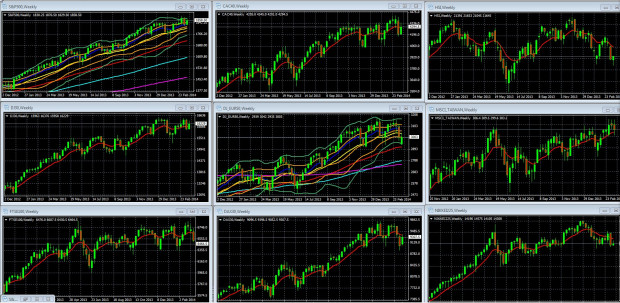

First we look at overall risk appetite as portrayed by our sample of global indexes, because the EURUSD has been tracking these fairly well recently.

Overall Risk Appetite: Sample Global Weekly Chart & Key Take-Aways

Our sample of weekly charts for leading global stock indexes suggests a mixed technical picture, with the US locked in a tight 5 week trading range but retaining its upward momentum, while Europe and Asia have pulled back in recent weeks under the combined weight of the Crimean situation and China slowdown fears exacerbated by what’s becoming weekly corporate bond defaults and weak data.

Weekly Charts Of Large Cap Global Indexes With 10 Week/200 Day EMA In Red: LEFT COLUMN TOP TO BOTTOM: S&P 500, DJ 30, FTSE 100, MIDDLE: CAC 40, DJ EUR 50, DAX 30, RIGHT: HANG SENG, MSCI TAIWAN, NIKKEI 225

KEY: 10 Week EMA Dark Blue, 20 WEEK EMA Yellow, 50 WEEK EMA Red, 100 WEEK EMA Light Blue, 200 WEEK EMA Violet, DOUBLE BOLLINGER BANDS: Normal 2 Standard Deviations Green, 1 Standard Deviation Orange

Source: MetaQuotes Software Corp, www.fxempire.com, www.thesensibleguidetoforex.com

01 Mar. 22 20.49

Key Take-Aways

Risk appetite, as portrayed by these weekly index charts, stabilized this week. That’s not surprising given that both military actions and sanctions have been within expectations, so fears of further escalation remain real but subdued. Overall, European indexes actually climbed throughout the week as this idea became more widespread.

The muddied overall risk appetite picture isn’t helpful this week, so we look to the weekly EURUSD chart

EURUSD Weekly Technical Outlook: Neutral On Daily Chart, Bullish on Weekly Chart

The weekly chart shows the pair pulled back, and the daily chart clarifies why.

EURUSD Weekly Chart, 2 June 2013 – 21 March 2014

KEY: 10 Week EMA Dark Blue, 20 WEEK EMA Yellow, 50 WEEK EMA Red, 100 WEEK EMA Light Blue, 200 WEEK EMA Violet, DOUBLE BOLLINGER BANDS: Normal 2 Standard Deviations Green, 1 Standard Deviation Orange

Source: MetaQuotes Software Corp, www.fxempire.com, www.thesensibleguidetoforex.com