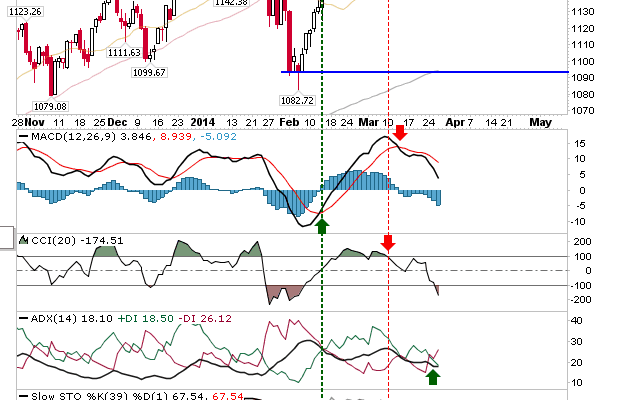

A day of hidden losses. The S&P rejected a fresh test of resistance, but didn’t take significant losses by the close. Volume climbed to register distribution, but it was well below Friday’s whopper volume.

However, Small Caps took a big hit, dropping nearly 2% as buyers stayed away. Â Losses were quick to undercut the 50-day MA and the March swing low. Next up is the February swing low and/or 200-day MA. Relief bounces are likely to be shorted at the 20-day MA.

The S&P experienced its second rejection of highs (the long upper candlestick wick) and resistance. Given the action in the Russell 2000 it may follow suit with a test of the 50-day MA on Friday. Â Note the sharp swing in relative strength in Large Caps favour – what money is out there from buyers will likely find its way here.

The Nasdaq undercut its 50-day MA as part of its losses. Like the S&P, it’s looking at the February (and December) swing low. Of the indices, there is an opportunity for a bearish head-and-shoulders reversal. Â For this to be true, the current sell off would need to make it all the way back to February’s support before a bounce to January’s swing high. From there, the Nasdaq would return to February’s lows and break below, setting up a measured move target of 3,650. But first steps first…

Given today’s action, tomorrow is set for more of the same. A rapid sell off in the morning may offer a day trade bounce, but sellers are building pressure for a larger move to the 200-day MA. Despite the higher highs, selling volume has been stronger than buying volume over 2014; another indication a larger bear trend is developing.