For the first time in over 6 weeks, all major US equity indices are in the red for 2014. Early-year leaders Nasdaq and Russell are being crushed by the battering of Biotechs and monkey-hammering of Momo names. Since FOMC, Momos are down 14% and Biotech down 12%. The high-growth hope is fading and nowhere is that more evident than the tumble in 30Y yields – now at 10-month lows. The hopes that financials would lead have nw left as they are also in the red post-FOMC (post-CCAR hope).

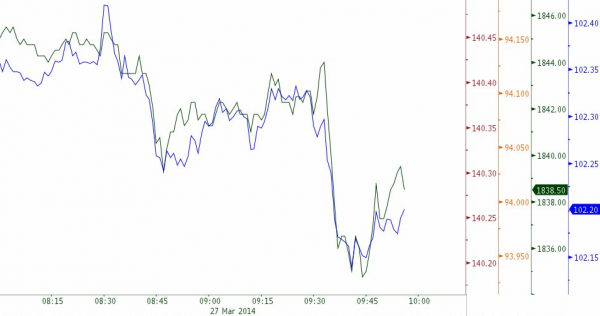

USDJPY in charge…

Stocks all red YTD…

Momos…

Biotechs…

As the 30Y hits 10-month low yields…

Charts: Bloomberg