Yesterday was window dressing day (facilitated at just the right time by Yellen’s most dovish commentary to date) not only for the hedge fund and vacuum tube community, but also for banks, which as we reported received a record $242 billion in Treasurys from the Fed via an all time high reverse repo. Which means that today, as the repo unwinds, the system will be flooded with over $100 billion.

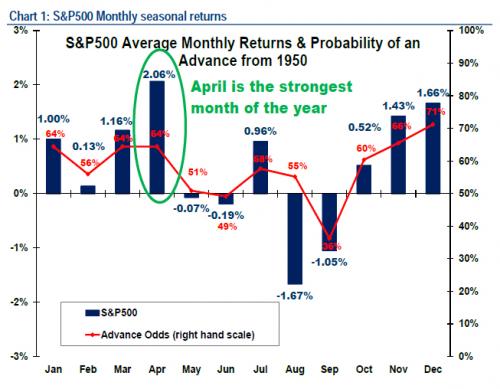

This brings us to the topic of what stocks may do today – while futures are already solidly in the green, perhaps on the abysmal Japanese Tankan results, or China’s Schrodinger economy, which has been growing and contracting ever since 2012, and posted PMIs that both beat and missed, or maybe it was the record high Italian unemployment reported overnight – will likely focus on just one thing: how to frontrun April performance in the first millisecond of trading. And since April is conventionally the stronger month of the year, and since all bad news are both ignored and priced in at the same time, expect yet another levitation day courtesy of our friends, the high freaks, whose time may be drawing to a close not because of the FBI investigation, which is a joke, but because Goldman has now picked a side, and it is not that belonging to the vacuum tubes.

Â

Among the key overnight events was the February Euro area unemployment report, which was unchanged at 11.9%, lower than the 12% median estimate; in Italy it rose to a record 13% while in Germany the locally defined jobless rate for March stayed at the lowest in at least two decades Euro zone PMI held at 53 in February, unchanged from January and matching median estimate in a Bloomberg survey HSBC/Markit’s China PMI fell to 48 in March, the lowest reading since July, from 48.5 in February; a separate PMI from the government, with a larger sample size, was at 50.3 from 50.2 the previous month NATO foreign ministers meet today to discuss their next steps after Putin began withdrawing forces stationed on Ukraine’s border Gazprom raised prices for Ukraine 44% after a discount deal expired, heaping financial pressure on the government in Kiev as it negotiates international bailouts.

RanSquawk confirms that overall, it has been a quiet session in Europe this morning, with the sentiment towards riskier assets supported by the release of an encouraging set of EU related PMIs and also lower than expected German unemployment rate, which fell to the lowest since German unification in 1989.

Looking at the day ahead, there are plenty of activity indicators to digest on the data docket. Beginning in Europe, the final Euroarea and UK PMIs will be released today together with the PMIs for Italy and Spain. Stateside, the focus will be on the ISM manufacturing and US auto sales data. There is market chatter that a number of US automakers will report strong March sales following the winter slump (Bloomberg). Right, onto the performance review.

Bulletin headline summary from Bloomberg and RanSquawk

- Treasuries decline, led by 10Y and 30Y; curve spreads steepen as unwind of post-Fed flattening continues; data and Fed speaker calendar light as market focuses on Thursday’s ECB meeting, Friday’s U.S. payrolls.

- Unemployment in the euro area was at 11.9% in February, lower than the 12% median in a Bloomberg News survey; in Italy it rose to a record 13% while in Germany the locally defined jobless rate for March stayed at the lowest in at least two decades

- Euro zone PMI held at 53 in February, unchanged from January and matching median estimate in a Bloomberg survey

- HSBC/Markit’s China PMI fell to 48 in March, the lowest reading since July, from 48.5 in February; a separate PMI from the government, with a larger sample size, was at 50.3 from 50.2 the previous month

- NATO foreign ministers meet today to discuss their next steps after Putin began withdrawing forces stationed on Ukraine’s border

- Gazprom raised prices for Ukraine 44% after a discount deal expired, heaping financial pressure on the government in Kiev as it negotiates international bailouts

- Japan’s economy will probably withstand a sales tax increase that takes effect today as Prime Minister Shinzo Abe prepares economic stimulus measures and companies raise wages, the country’s new bank lobby chief said

- The first phase of Obamacare ended yesterday much the same way it began: The federal website drew 1.2 million visitors by noon and crashed at least twice

- Federal agents are investigating whether high-frequency trading firms break U.S. laws by acting on nonpublic information to gain an edge over competitors

- Sovereign yields higher. Asian stocks mostly higher. European equity markets, U.S. stocks futures gain. WTI crude and copper lower, gold gains