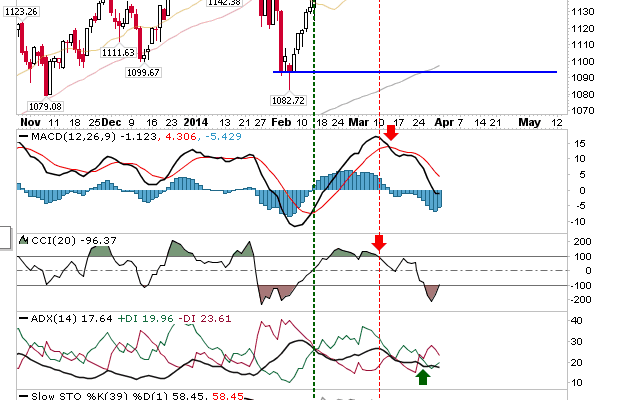

Buyers had laid out the ground rules for Monday’s gain on Friday, and they grabbed their opportunity with both hands. Small Caps had the best of the action (as it had suffered the most at the hands of sellers), pushing itself back above its 50-day MA. Â Intermediate slow stochastics [39,1] managed to honor mid-line support as short term stochastics [14,3] generated bullish crossover – a decent ‘buy’ signal with a stop on a loss of 1,146; a set up similar to November’s swing low last year. Take partial profits on a test of the 20-day MA.

The Nasdaq banked most of its gain at the opening gap, but it did add a little more by the close of business. It has a similar stochastic (buy) set up as the Russell 2000, but it still has to contend with supply at nearby 50-day MA. A fresh probe of 4,131 support would offer another long-side opportunity, but look for buying momentum to pick up once it closes above its 50-day MA. Stop on loss of 4,131.

The S&P is the long term holders favorite. It was able to register an accumulation day as the index made another attempt at challenging all-time high resistance. This 4-week consolidation looks ready to push on to new highs. Prepare for an upside breakout. Â When this happens, stops go on a confirmed ‘bull trap’; i.e. a close below 1,880. As it stands, risk is measured on a loss of 1,842.

Today may see some push back from bears given they dominated action last week, but yesterday set up the ground work for a swing low. The buying wasn’t enough to confirm a low based on breadth (Percentage of Nasdaq Stocks above 50-day MA, Bullish Percents Index, Nasdaq Summation Index), but it was an important step in the right direction.