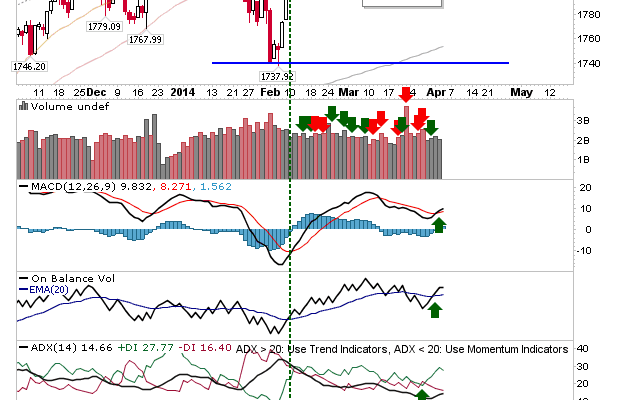

The swing trade opportunity sided with the bears, but for Large Caps it wasn’t a big swing. The S&P maintained its breakout, and could take another loss and remain above breakout support. Technicals are still net bullish, which makes the short play a weak one.

The Nasdaq took a more substantial hit in a clearer short play. However, losses took the index a shade below breakout support (but not enough to register as a confirmed breakdown).

The Russell 2000 finished with a bearish engulfing pattern, undercutting the 20-day MA by the close. The challenge on the all-time high may have to wait until there is a fresh test of the 50-day MA. Â However, the Russell 2000 is in a scrappy phase without a clear advantage to one side or the other.

Tomorrow is set for further losses, particularly for the Russell 2000 and Nasdaq, but the overall picture is at worst, bears will have their work cut out (particularly with Large Caps siding far more with bulls). Â Not a great environment to trade.