Things were going alone just fine last week, until Friday. Â That’s when investors decided to turn tail. Â Perhaps it was last month’s unemployment numbers that spurred some fear. Â Or, perhaps it was just the fact that investors felt the market was overbought and didn’t want to be left holding the bag should things turn sour over the weekend.Â

Whatever the reason, it couldn’t have come at a worse time (for the bulls).  One of the key indices broke under a floor that had been playing a huge support role since mid-2013.  Now that it’s broken, the game truly has changed.

We’ll take a look at what’s likely to be next for the market in a moment. Â Let’s take a detailed look at last week’s economic framework first.Â

Economic Calendar

While there was plenty on the economic dance card last week last week, there was only one area that investors really cared about – an update of the employment picture.  It was… quite mediocre.

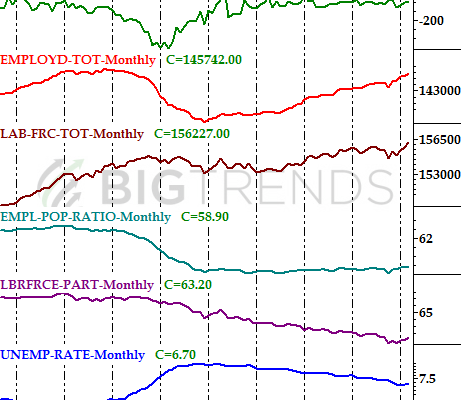

First and foremost, the nation added 197,000 new jobs last month, essentially in line with the 191,000 payrolls that ADP reported early in the week.  That’s a step forward, though not a big one – the unemployment rate remained stuck at 6.7%.  Hourly earnings were flat, and the average number of hours worked per week only swelled from 34.3 to 34.5.Â

Employment Trends Chart

Source: Â Bureau of Labor Statistics.

In many ways the jobs numbers were perfect for the market.  They weren’t so strong that the Fed is going to be in a hurry to put the brakes on the modest economic strength.  Yet, they weren’t so weak that we have to fear an economic implosion.  Clearly investors didn’t make that same interpretation on Friday, however.Â

Economic Calendar

Source: Â Briefing.com.

As the calendar showed, there’s not much on the way this week in terms of economic numbers.  And, even within what little we’re getting, there’s not much that could be market-moving.  It should be a relatively tame week, data-wise, which works out ok – earnings season begins this week and all eyes will be on those earliest quarterly reports. Â