Update:Â As CNBC just reported moments ago, tech fund Coatue is returning $2 billion of $7 billion to investors, citing “difficult market conditions.” Just wait until the “difficult market” drops more than just 3% from all time highs…

Over the past few days we have been following, with great interest, the events in the most popular “hedge fund hotel” names on both the long and the short side. Specifically, over the weekend we learned that the mauling that hedge funds suffered in the last week of March, which was also the worst week for HF performance since 2001 excluding “world ending” weeks such as Lehman and the US debt crisis, spilled over into last week as well.

As a reminder, for those with Bloomberg (and the proper permissions) the easiest way to track the performance of the most popular hedge fund names is using the BBG ticker GSTHHVIP, and especially its performance against the S&P. But for those who don’t have access, or are too lazy or depressed to type anything into their terminal today, here it is, straight from Goldman’s sales and trading mouth, summarizing yesterday’s market poundage:

Our HF VIP basket underperforms the SPX by over 100bps, 3 standard dev move and the worst since June 2012.

Oops.

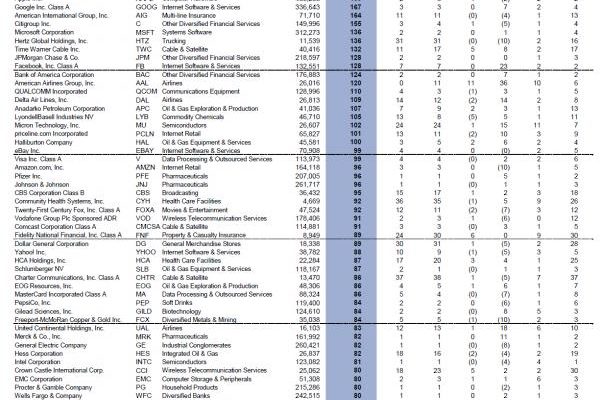

And since we enjoy being helpful, for those who want to keep the pain on the hedge fund space the easiest way to do this is to keep selling and/or shorting the names the comprise said Goldman GSTHHVIP basket, something we suggested is the right trade past few days . The breakdown is as follows (sorry General Motors and your latest airbag inquiry):

Why trade this? Because recall that hedge fund leverage, as indicated by the following leverage table of one of the “more” levered smart money participants, Balyasny, has never been greaterand is now 3.5x – 4.0x.

In other words, either hedge funds rapidly deleverage once the margin calls finally slam the hammer on the smart money, which will crash stocks further, or hedge funds sell the widest held stocks over fears of what other hedge funds do, which also will crash stocks further.