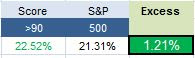

The highest scoring names in large cap from 1 year ago (4/9/2014) returned an average 22.52% in the past year. Performance has been led MGA up 74%, NOC up 73%, CMG up 67%, and GLW up 64%.

- Utilities are the top scoring large cap sector.

- Industrial metals & minerals is the top scoring industry.

The average large cap score is 56.92 this week, below the four week moving average score of 60.90. The average large cap is trading -11.22% below its 52 week high, 2.49% above its 200 dma, has 3.93 days to cover short, and is expected to grow earnings by 14.06% next year.

Â

Utilities, industrial goods, healthcare and consumer goods score above average this week. Basics score in line. Technology, financials, and services score below average.

| LARGE CAP |  |  |  | 4/10/2014 | 4 Week MA |

| Company Name | Symbol | Sector | INDUSTRY | SCORE | SCORE |

| BEST | Â | Â | Â | Â | Â |

| Amphenol Corp | APH | TECHNOLOGY | DIVERSIFIED ELECTRONICS | 105 | 98.75 |

| Avalonbay Comm. | AVB | FINANCIALS | REITS | 105 | 82.5 |

| Eqt Corp | EQT | UTILITIES | GAS UTILITIES | 105 | 91.25 |

| Johnson & Johnson | JNJ | HEALTHCARE | DRUG MANUFACTURERS | 105 | 80 |

| Kellogg Company | K | CONSUMER GOODS | PROCESSED & PACKAGED GOODS | 105 | 82.5 |

| Burger King | BKW | SERVICES | RESTAURANTS | 100 | 96.25 |

| EnCana Corp | ECA | BASIC MATERIALS | INDEPENDENT OIL & GAS | 100 | 95 |

| Edison Intl | EIX | UTILITIES | ELECTRIC UTILITIES | 100 | 85 |

| Essex Ppty Trust | ESS | FINANCIALS | REITS | 100 | 93.75 |

| Intuitive Surgical | ISRG | HEALTHCARE | MEDICAL APPLIANCES & EQUIPMENT | 100 | 92.5 |

| Wisconsin Energy | WEC | UTILITIES | DIVERSIFIED UTILITIES | 100 | 86.25 |

| Core Lab | CLB | BASIC MATERIALS | OIL & GAS EQUIPMENT & SERVICES | 95 | 91.25 |

| Camden Ppty | CPT | FINANCIALS | REITS | 95 | 81.25 |

| Covance Inc. | CVD | HEALTHCARE | RESEARCH SERVICES | 95 | 90 |

| Dover Corp | DOV | INDUSTRIAL GOODS | DIVERSIFIED MACHINERY | 95 | 72.5 |

| The Directv Group Inc | DTV | TECHNOLOGY | COMMUNICATION EQUIPMENT | 95 | 80 |

| Entergy Corp New | ETR | UTILITIES | ELECTRIC UTILITIES | 95 | 68.75 |

| Edwards Lifesciences | EW | HEALTHCARE | MEDICAL APPLIANCES & EQUIPMENT | 95 | 90 |

| General Dynamics | GD | INDUSTRIAL GOODS | AEROSPACE/DEFENSEÂ PRODUCTS & SERVICES | 95 | 91.25 |

| Green Mtn. Coffee Roasters | GMCR | CONSUMER GOODS | PROCESSED & PACKAGED GOODS | 95 | 81.25 |

| Idexx Lab | IDXX | HEALTHCARE | DIAGNOSTIC SUBSTANCES | 95 | 83.75 |

| Illumina | ILMN | HEALTHCARE | BIOTECHNOLOGY | 95 | 90 |

| Eli Lilly | LLY | HEALTHCARE | DRUG MANUFACTURERS | 95 | 73.75 |

| Microchip Tech | MCHP | TECHNOLOGY | SEMICONDUCTOR-SPECIALIZED | 95 | 101.25 |

| Mdu Res Group Inc | MDU | INDUSTRIAL GOODS | GENERAL BUILDING MATERIALS | 95 | 88.75 |

| Merck | MRK | HEALTHCARE | DRUG MANUFACTURERS | 95 | 83.75 |

| Nextera Energy | NEE | UTILITIES | ELECTRIC UTILITIES | 95 | 92.5 |

| O’Reilly Auto | ORLY | SERVICES | AUTO PARTS STORES | 95 | 88.75 |

| Pentair | PNR | INDUSTRIAL GOODS | INDUSTRIAL EQUIPMENT & COMPONENTS | 95 | 83.75 |

| P P L Corp | PPL | UTILITIES | ELECTRIC UTILITIES | 95 | 78.75 |

| Reynolds American | RAI | CONSUMER GOODS | CIGARETTES | 95 | 86.25 |

| S L Green | SLG | FINANCIALS | REITS | 95 | 88.75 |

| Transdigm Group Inc. | TDG | INDUSTRIAL GOODS | AEROSPACE/DEFENSEÂ PRODUCTS & SERVICES | 95 | 91.25 |

| Tyson Foods | TSN | CONSUMER GOODS | MEAT PRODUCTS | 95 | 93.75 |

| Xcel Energy Inc | XEL | UTILITIES | ELECTRIC UTILITIES | 95 | 87.5 |

| Alexion Pharma | ALXN | HEALTHCARE | DRUG MANUFACTURERS | 90 | 87.5 |

| Autozone | AZO | SERVICES | AUTO PARTS STORES | 90 | 92.5 |

| Brown Forman Corp | BF.B | CONSUMER GOODS | BEVERAGES | 90 | 80 |

| Cameco | CCJ | BASIC MATERIALS | INDUSTRIAL METALS & MINERALS | 90 | 73.75 |

| Continental Resources | CLR | BASIC MATERIALS | OIL & GAS DRILLING & EXPLORATION | 90 | 91.25 |

| Cummins Inc | CMI | INDUSTRIAL GOODS | DIVERSIFIED MACHINERY | 90 | 78.75 |

| Campbell Soup | CPB | CONSUMER GOODS | PROCESSED & PACKAGED GOODS | 90 | 77.5 |

| C V S Corp | CVS | SERVICES | DRUG STORES | 90 | 88.75 |

| Walt Disney Company | DIS | SERVICES | ENTERTAINMENT- DIVERSIFIED | 90 | 91.25 |

| DaVita Inc | DVA | HEALTHCARE | SPECIALIZED HEALTH SERVICES | 90 | 87.5 |

| Eastman Chemical Co | EMN | BASIC MATERIALS | CHEMICALS- MAJOR DIVERSIFIED | 90 | 87.5 |

| E O G Resources | EOG | BASIC MATERIALS | INDEPENDENT OIL & GAS | 90 | 80 |

| Corning | GLW | TECHNOLOGY | COMMUNICATION EQUIPMENT | 90 | 91.25 |

| Goodyear Tire | GT | CONSUMER GOODS | RUBBER & PLASTICS | 90 | 70 |

| Halliburton | HAL | BASIC MATERIALS | OIL & GAS EQUIPMENT & SERVICES | 90 | 88.75 |

| Intel | INTC | TECHNOLOGY | SEMICONDUCTOR- BROAD LINE | 90 | 61.25 |

| L3 Communications | LLL | SERVICES | SECURITY & PROTECTION SERVICES | 90 | 87.5 |

| Lorillard Inc | LO | CONSUMER GOODS | CIGARETTES | 90 | 90 |

| Medtronic | MDT | HEALTHCARE | MEDICAL APPLIANCES & EQUIPMENT | 90 | 72.5 |

| Mead Johnson Nutrition | MJN | CONSUMER GOODS | PROCESSED & PACKAGED GOODS | 90 | 76.25 |

| Northrup Grumman | NOC | INDUSTRIAL GOODS | AEROSPACE/DEFENSEÂ PRODUCTS & SERVICES | 90 | 86.25 |

| Public Service Ent. | PEG | UTILITIES | DIVERSIFIED UTILITIES | 90 | 85 |

| Quanta Svcs Inc | PWR | INDUSTRIAL GOODS | GENERAL CONTRACTORS | 90 | 77.5 |

| Scana Corp New | SCG | UTILITIES | DIVERSIFIED UTILITIES | 90 | 86.25 |

| Constellation Brands | STZ | CONSUMER GOODS | BEVERAGES | 90 | 71.25 |

| Time Warner Cable Inc | TWC | SERVICES | CATV SYSTEMS | 90 | 76.25 |

| Under Armor | UA | CONSUMER GOODS | TEXTILES | 90 | 78.75 |

| Weatherfold International Inc | WFT | BASIC MATERIALS | OIL & GAS EQUIPMENT & SERVICES | 90 | 87.5 |

| Â | Â | Â | Â | Â | Â |

| WORST | Â | Â | Â | Â | Â |

| Bed Bath & Beyond | BBBY | SERVICES | HOME FURNISHING & FIXTURES | 15 | 26.25 |

| Fireeye Inc | FEYE | TECHNOLOGY | APPLICATION SOFTWARE | 15 | 43.75 |

| Gerdau SA | GGB | BASIC MATERIALS | STEEL & IRON | 15 | 27.5 |

| Mattel Inc | MAT | CONSUMER GOODS | TOYS & GAMES | 15 | 35 |

| Nomura Holdings | NMR | FINANCIALS | INVESTMENT BROKERAGE | 15 | 23.75 |

| Sei Investments Co | SEIC | FINANCIALS | INVESTMENT BROKERAGE | 15 | 40 |

| Alnylam Pharma | ALNY | HEALTHCARE | BIOTECHNOLOGY | 20 | 32.5 |

| Mobile Telesystems OJSC | MBT | TECHNOLOGY | WIRELESS COMMUNICATIONS | 20 | 40 |

| Qiagen NV | QGEN | SERVICES | RESEARCH SERVICES | 20 | 38.75 |

| Rackspace Hosting Inc. | RAX | TECHNOLOGY | INFORMATION TECHNOLOGY SERVICES | 20 | 27.5 |