US Consumers May Be Able To Spend-But Are They Willing? If So, What Are The Likely Scenarios For USD, Other Currencies?

The following is a partial summary of the conclusions from the fxempire.com  fxempire.com ’ meeting in which we share thoughts about key developments worth a special report.Â

This one is a critique of a James Kostohryz’s recently released 2014 Q2-Q4 US forecast. Our focus is on its implications for forex traders, although much of it applies for all markets.Â

Summary Of Kostohryz’s Forecast

Here are Kostohryz’s main points.

- Rising Consumer Spending: Improved liquidity plus rising pent-up demand for US households will drive consumer spending. Beneficiaries include the consumer durables, and discretionaries sectors.

- Rising Business Spending: Similarly improved liquidity plus rising pent-up demand will drive higher capex spending and hiring.

- Higher Than Expected US GDP Growth: Driven by the above unexpectedly strong consumer and business spending

- Rising Yields: Benchmark US 10 year note yield to 3.5% level at some point in 2014 in reaction to the above points 1-3.

- Rising Volatility: Financial market volatility to increase for the rest of 2014 due to the above factors. Specifically, high anxiety in credit markets about rising yields could infect the bull market in risk currencies, stocks, and other risk assets.

- This is a valuable forecast, well written and thought out. That said, we see two main flaws.

- It rests on an uncertain belief that the US consumer is ready to spend.

- It assumes US growth necessarily brings a stronger US Dollar. Not necessarily.

Critique: Are US Consumers May Be Ready To Spend-But Are They Willing?

The accuracy of Kostohryz’s forecasts rests on whether or not he’s right that consumer spending will greatly exceed expectations for the rest of 2014. The other predictions mostly follow from that, as we discuss below.

He makes a compelling case that consumers have cut debt and built up cash. Here are the highlights.

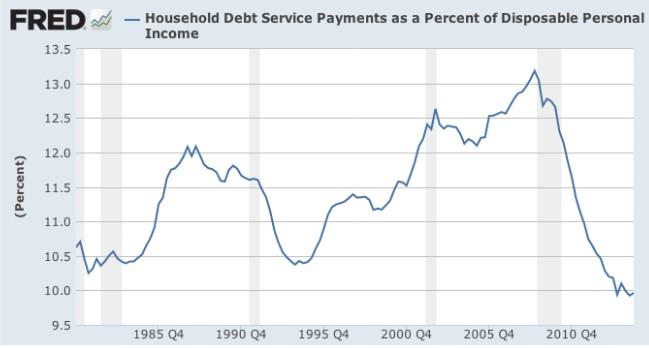

Consumer Debt Way Down

Household Debt Service Versus Income

(via http://jameskostohryz.com/ 2014 Q2-Q4 US forecast)

01 Apr. 04 10.36

Household Debt Versus Income

(via http://jameskostohryz.com/ 2014 Q2-Q4 US forecast)

02 Apr. 04 10.39

Consumer Cash Way Up

Household Liquid Assets Versus Income

(via http://jameskostohryz.com/ 2014 Q2-Q4 US forecast)

03 Apr. 04 10.47

Household Net Worth At All Time High

(via http://jameskostohryz.com/ 2014 Q2-Q4 US forecast)

04 Apr. 04 10.5

They May Be Able, But Are They Really Willing?

However he fails to make a compelling case that they’re willing to accelerate spending in 2014. Evidence of soaring consumer confidence, new jobs and income growth would have made a compelling case for a wave of consumer spending.

As Kostohryz himself admits, increased hiring feeds consumer confidence, and rising consumer confidence feeds hiring as businesses expand to meet anticipated capacity. The two data points feed each other. He notes these are improving, but does not present evidence that these are set for a sudden rapid increase in 2014. That’s understandable, the data isn’t there yet. Â

Even if it were, the timing of when fundamental factors impact other data, and markets, is notoriously difficult.

Why Spending Doesn’t Spike

We’d add that there are reasons to believe consumers may choose to continue to increase their liquidity rather than spending.

No Rapid Increase In Job & Income Growth: The continued weak job and income growth should keep limit speed and extent of spending growth. For example, the most recent jobs report affirmed the current picture of steady but slow improvement. While positive, that’s unlikely to unleash soaring consumer confidence and spending.

No Burst Of Consumer Confidence: Given the lack of rapid job and wage growth, why should we anticipate a sudden burst in consumer confidence? If anything, the likely best case outcome is that it too will improve at a modest pace, in line with recent data.