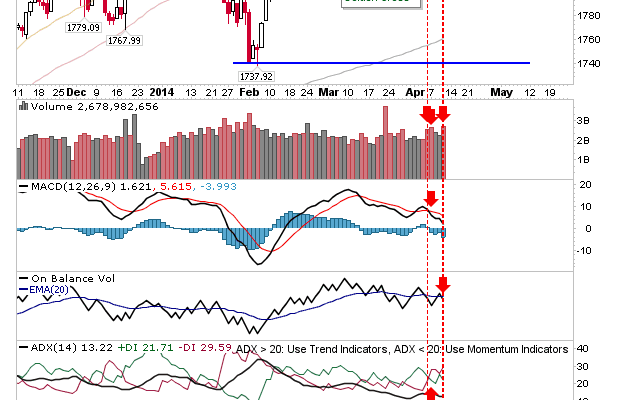

In relative terms, the S&P has been well ahead of the Russell 2000 and Nasdaq for bullishness, but yesterday was an important victory for bears. The break above the 20-day MA from Wednesday failed to hold, and the resulting move lower was enough to undercut converged ranged support and 50-day MA. To add to the troubles, volume climbed in confirmed distribution. Â Finally, supporting technicals all turned net bearish. Â If there is a ray of light for bulls, it’s that a 2% loss is likely to be followed by some value buying; value buying which may yet lead to a ‘bear trap’.

The Nasdaq accelerated its losses, and is on course for a test of the February swing low. The index is oversold, at a level which could see a bounce of a couple of weeks, but best to wait for the narrow range day to define entry and risk.

The Russell 2000 was not left out of yesterday’s carnage, losing nearly 3%. Â It’s on a fast track course towards its 200-day MA, with the February swing low to grab it after that.

Losses in the indices accelerated, but these are unlikely to be sustainable for long. Markets do look like they want to test February lows. And the further they move away from March highs, and the closer things get to the summer, the less likely we are going to see another challenge of the March high this year. Â Will the March high ultimately provide the target for a latter year ‘Santa Rally’? Too early to say, but profit takers seem happy to sell at whatever price they can get, few look willing to buy-and-hold.