Methodology

Our weekly best and worst reports show you stocks with the best potential returns over the coming 6 to 12 months. The score is calculated by fusing together the key drivers of price movement including, earnings beats, earnings growth, at-the-market insider buys, institutional activity, short ratio analysis, price to earnings analysis and calendar quarter seasonality. Those stocks appearing in our best list should be bought while those appearing in our worst list should be sold.

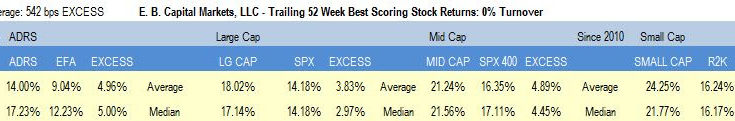

Top scoring weekly returns:Â Buy and Hold 1 Year

- Utilities remain the top scoring sector across our universe

Â

Only utilities exit the week with an average score above the universe average.

Â

Industrial goods and consumer goods score in line.

Â

Healthcare, basics, financials, technology and services score below average.

Â

Typically, markets improve in the second half of April (see daily trading chart later in today’s report).

Â

The following chart shows average four, eight, and 12 week scores across our universe. Scores continue to retreat with the four week moving average score now the lowest since 2012.

Historically, market headwinds fade in the second half of April.

Â

Â

UTILITIES

Â

Utilities are typically strong in the shoulder months ahead of summer peak seasonal demand. The XLU has, on average, outpaced the SPY in each month of Q2 over the past decade

The cold winter weather boosted U.S. electricity retail sales by 4.3% year-over-year during Q1, led by a 7.3% increase in the residential sector. The EIA projects residential sales in Q2 and Q3 will average 0.6% more than last year, supported by a 5.8% increase in summer cooling degree days. Overall, total electricity generation is expected to be 1.8% higher in 2014 than 2013.

Â

Best Scoring

Â