Time to pay your taxes.

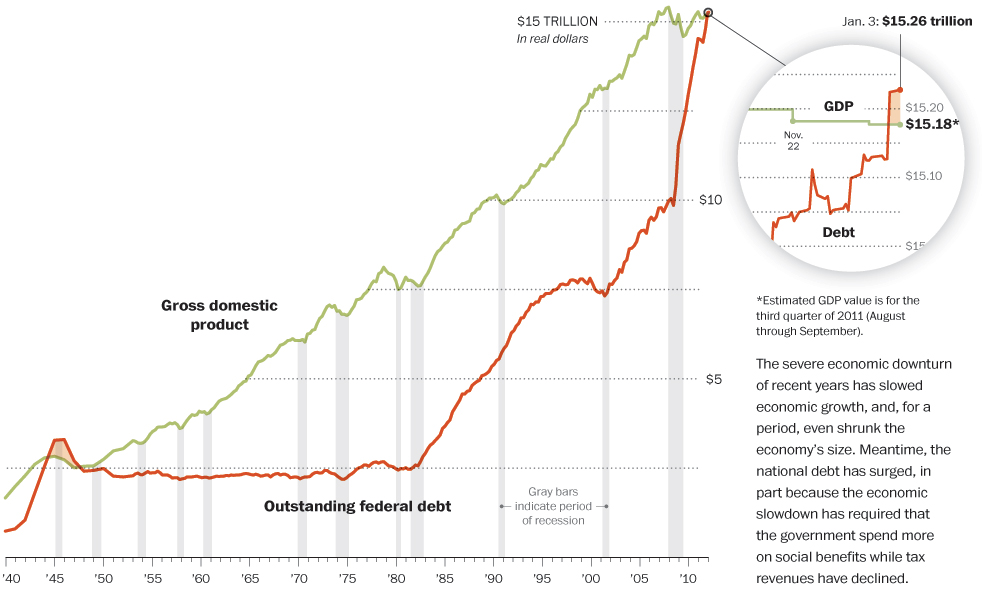

But, fortunately, it’s still not time to pay the piper for all that money we’re borrowing to goose the economy. Â Well, goose may be too strong a term as 5 years and $5 Trillion Dollars into this mess, we’re really only flatlined the GDP to where it was back in 2007.Â

Â

Did you get your $5,000,000,000,000 worth? We know the top 0.01% sure did. We’ve made the World’s Billionaires alone $1.4Tn richer than they were in 2009 – and it only cost 140M working Americans $37,714 each!  That’s how much $5Tn in additional debt has cost us – on top of the $2.5Tn we piled on fighting Iraq or Afghanistan for whatever reason it was we had to invade those guys.Â

Â

Don’t worry, it’s all fair, each one of those Billionaires also owes the same $37,714 as you do – they feel your pain!  Multiply that by 3.5 and that’s your share of the National Debt, which is still growing by $500Bn a year, although that’s 1/2 of how fast it was growing under Bush II.  And, of course, we’re not even counting the Fed’s $4Tn of additional debt – because we still get to pretend that will all work itself out in the end. Â

Just like CHINA!!!  China’s Central Bank has been trying to drain a little liquidity out of the system and it looks like that’s already dropped GDP growth for the quarter down to 1.5%, nowhere near the 7.5% annual levels the Government was hoping for. That led Chinese stocks to fall about 1.5% this morning, led down by Financial and Commodity stocks. That’s the reaction to M2 (money supply) GROWING by 12.1% instead of the 13.3% it was growing a month earlier and despite $169Bn in loan growth.

Â

[Chart by Dave Fry]

“Investors are a bit worried because M2 is quite low,†Zhang Haidong, an analyst at Tebon Securities Co., said by phone in Shanghai. “New loans may be better than expected by a little, but it’s still not considered good data; we still think liquidity is very tight.â€