Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

We’ve made no secret about our bearishness on certain cloud stocks. Over the past several months, we’ve featured Callidus (CALD), Netsuite (N), Salesforce (CRM), and Tangoe (TNGO) in the Danger Zone. On average those stocks have dropped 14% since our calls. The cloud sector as a whole has been beat up with the First Trust ISE Cloud Computing Index ETF (SKYY) down 7% over the past month while the S&P 500 is down only 2%.

This week’s Danger Zone stock, Workday (WDAY: $75/share) has been hit worst than most. Over the past month it has dropped 25%. Some investors might be tempted to “buy on the dip hereâ€, but they should resist that temptation. WDAY remains significantly overvalued and has much farther to fall before it reaches a valuation supported by its fundamentals.

Lack of Profitability

Anyone familiar with the sector knows that most of these high-flying cloud stocks don’t make any money, and WDAY is no exception. WDAY actually is in worse shape here than most of its competitors. Its after-tax profit (NOPAT) margin currently stands at -32%, which is worse than N at -13%, CALD at -9%, and CRM at -4%.

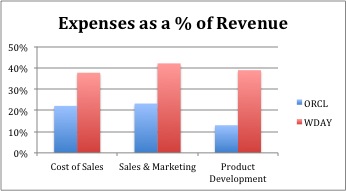

The argument WDAY bulls assert is that profits don’t matter now as WDAY is boosting spending on sales and marketing and product development to spur revenue growth, which was 71% last year. Figure 1 shows the difference between WDAY’s expenses and those of a mature company like Oracle (ORCL).

Figure 1: WDAY vs ORCL Spending

Sources:Â Â New Constructs, LLC and company filings

We can see from figure 1 that WDAY spends, as a % of revenue, nearly double the amount of Oracle on Sales & Marketing and nearly triple on Product Development. It’s gross margin is also significantly lower as 24% of WDAY’s revenue still comes from its very low margin Professional services segment, which exists more to retain customers than to actually generate cash flow.

Bulls will argue that if WDAY just cut down those two expenses, Sales & Marketing and Product Development, it could instantly be profitable. WDAY could reach profitability by cutting those two expenses to the same % of revenue as Oracle; however, the company’s after-tax profit (NOPAT) would be a meager $40 million. Remember, this is a company with a market cap of nearly $14 billion. The current valuation makes no sense.