As unemployment declines and the labor market tightens up, many expect wages to rise. Then as wages rise, inflation has a chance to perk up again. But I want to show a graph that I will be watching in order to determine if inflation will truly respond to rising labor income.

The national income is divided into income for labor and for capital. Each will use part of its income to consume. What I will be watching is how each changes its consumption. The basic idea is that if we start to see wage inflation and labor income rising, people will think that inflation pressures are returning. However, if consumption by capital income starts to fall at the same time, there might not be as much inflation pressure.

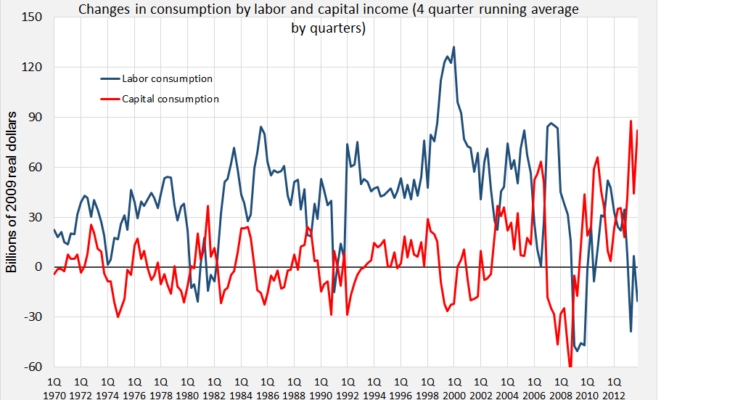

Here is the graph for the quarterly changes in consumption by labor and capital as based on the NIPA data. The plot shows the running average for the 4 previous quarters.

In the past, normally real labor income was always rising even through most recessions seen by the line being positive. Consumption by capital income on the other hand would rise and fall. Yet, things have been getting turned around in the past two years or so. Consumption by capital income has been growing quite fast while labor consumption has actually been falling.

Capital consumption rose by an average of $80 billion on a quarter basis through 2013. Labor consumption fell by $20 billion quarterly on average in 2013. So we actually had an overall average of a $60 billion increase on a quarterly basis for consumption.

We can see in the graph that capital income is capable of turning off the spigots of consumption quickly. And the two lines mostly moved in opposite directions but sometimes in the same direction. So if the blue line of labor consumption was to rise to +$60 billion for a previous year quarterly average, and say capital consumption was to fall to zero, we would still have the same net positive $60 billion increase per quarter in overall consumption. The perceived boost for inflation from rising labor income would be offset by the falling capital consumption. So any rise in labor consumption must be weighed against any change in capital consumption.