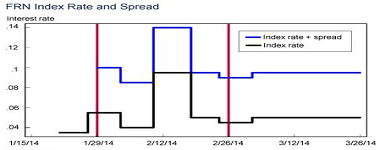

The U.S. Department of the Treasury (Treasury) auctioned its first floating-rate note (FRN) on January 29, 2014. With this auction, Treasury introduced the first new marketable debt instrument since Treasury inflation-protected securities (TIPS) in 1997. The new two-year FRN is a fixed-principal security with quarterly interest payments and interest rates indexed to the thirteen-week Treasury bill. In this post, we will discuss Treasury’s reasons for adopting an FRN as well as the existing FRN markets, expected FRN market participants, and results of the first FRN Treasury security auction.

Why Adopt an FRN?

Treasury generally seeks to minimize the long-run cost of issuing government debt. By adding a new product to the existing offering of marketable debt securities, Treasury expects that the investor base will expand, which will serve to lower Treasury’s borrowing cost. Recently, Treasury has also been extending the maturity of its debt portfolio as part of its strategy to control the overall cost of financing in a way that remains resilient during periods of market volatility and to lower the risk of a failed auction.

From an investor perspective, FRNs have less exposure to rising rates because of the frequent rate resets, and they pay interest more frequently than current coupon two-year securities. At the same time, FRNs may offer investors a slightly higher yield and fewer transaction costs than consistently rolling over a position in the thirteen-week bill, despite providing nearly identical cash flows.

Designing the FRN

Treasury first considered issuing FRNs, as well as TIPS, in 1994 as part of a plan to broaden its portfolio and investor base. In 1997, Treasury opted to introduce only TIPS and made no subsequent public mention of FRNs until 2011, when a Treasury Borrowing Advisory Committee (TBAC) presenter suggested that a floating-rate note could play a role in a maturity extension program. Since then, Treasury has worked over an extended period with the public and TBAC to design the eventual structure of the FRN, summarized in the timeline below.