There is a reason why while Germany has been delighted to keep the Euro as its currency, in the process keeping a substantial discount to where the Deutsche Mark would be trading if it weren’t for the implicit FX subsidies by ther Eurozone members, France has been increasingly more panicked and vocal about the soaring EUR. That reason became apparent this morning when Markit reported that France PMI for April both declined from the March print of 52.1, and missed expectations of 51.9, printing at 50.9. Same thing for the Services PMI which at 50.3, both missed expectations of 51.3, and dropped from 51.5.

Markit summarized the French move as follows:

- Flash France Composite Output Index falls to 50.5 (51.8 in March), 2-month low

- Flash France Services Activity Index slips to 50.3 (51.5 in March), 2-month low

- Flash France Manufacturing Output Index drops to 51.6 (53.3 in March), 2-month low

- Flash France Manufacturing PMI falls to 50.9 (52.1 in March), 2-month low

More:

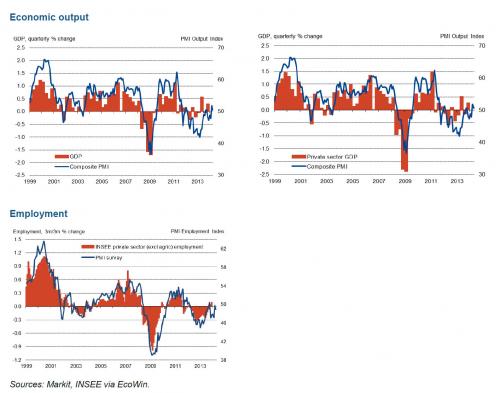

French private sector output rose for a second consecutive month in April, although the rate of expansion eased to a marginal pace. This was signalled by the Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, posting 50.5, down from 51.8 in March.

Weaker rates of output growth were recorded in both the service and manufacturing sectors during April. Services activity rose only fractionally, while manufacturers indicated a modest increase in production.

Latest data pointed to a stagnation of new business during April, following a modest rise in the previous month. A slight reduction in new work at service providers offset a moderate rise at manufacturers. Anecdotal evidence suggested that a number of clients were operating with tight budget constraints, while others were adopting a wait-and-see attitude before committing to new projects. New export orders at manufacturers increased modestly, albeit at a slightly slower pace than in March.