Unless you bought a house in the last year, you probably didn’t even notice.

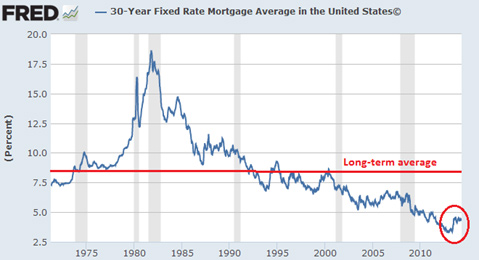

Mortgage interest rates, which had been declining since 1981, have spiked. After touching a record-low 3.3% in 2013, a 30-year, fixed-rate mortgage costs about 4.3% today.

That 30% increase in just a few months sounds huge. But by zooming out a bit, we can see the full picture: at 4.3%, the rate on a 30-year mortgage remains just half of its long-term average of 8.5%:

From this view, the spike looks more like the beginning of a return to normalcy than a worrisome signal. So, it’s no big deal, right?

Not exactly. As today’s guest author and seasoned banking executive Frank Trotter will explain, even small changes in mortgage rates reverberate to all corners of the economy. When your mortgage payment rises, your discretionary income drops, so you both spend and save less. Follow that daisy chain to its logical end and you’ll find that, to varying degrees, all businesses are at the mercy of mortgage rates—whether they know it or not.

And while it’s true that the recent mortgage rate spike is small in a historical context, remember that it marks the reversal of a 32-yeardowntrend. In other words, it’s a game changer.

Before I pass it to Frank, let me first mention that we’ve chosen San Antonio, Texas as the location for our next Casey Research Summit to be held from September 19-21. We’re still finalizing the agenda and faculty list, but registration is open—you can save up to $400 by signing up now and taking advantage of our early-bird pricing. Click here for more info and to register.

Dan Steinhart

Managing Editor of The Casey Report

The Latest Bubble to Pop: Mortgage Refinancings

We’ve fallen and can’t quite get up!

Sometimes the unending stream of economic numbers starts to look like the dripping green images in The Matrix.

We attempt to be Cypher, “conceptualizing†the image through the digits: “All I see now is blonde, brunette, redhead.†But our collective attempts at econometric modeling on the fly often result in a muddled, rather than precise, picture.

Still, there are moments when the world clarifies before our eyes. August 1971. October 1979. September 2001. September 2008.

And then there was May and June 2013.

Maybe you’re thinking, Um, Greece? Syria? Budget negotiations? Debt ceiling debates? Something in Congress?

Nope.

Right now and for the past several years, interest rates have been at a 50-year low. Many people focus on the short-term yields. But the 10-year Treasury Note remains below the red line on my chart that illustrates rates all the way back to 1960.