Picking from the multitude of sector ETFs is a daunting task. In any given sector there may be as many as 45 different ETFs, and there are at least 181 ETFs across all sectors. Why are there so many ETFs? The answer is: because ETF providers are making lots of money selling them. The number of ETFs has little to do with serving investors’ best interests. Below are three red flags investors can use to avoid the worst ETFs:

- Inadequate liquidity

- High fees

- Poor quality holdings

I address these red flags in order of difficulty. Advice on How to Find the Best Sector ETFs is here. Details on the Best & Worst ETFs in each sector are here.

How To Avoid ETFs with Inadequate Liquidity

This is the easiest issue to avoid, and my advice is simple. Avoid all ETFs with less than $100 million in assets. Low asset levels tend to mean lower volume in the ETF and large bid-ask spreads.

How To Avoid High Fees

ETFs should be cheap, but not all of them are. The first step here is to know what is cheap and expensive.

To ensure you are paying at or below average fees, invest only in ETFs with an expense ratio below 0.52%, which is the average expense ratio of the 181 US equity ETFs I cover. Weighting the expense ratios by assets under management, the average expense ratio is lower at 0.32%. A lower weighted average is a good sign that investors are putting money in the cheaper ETFs.

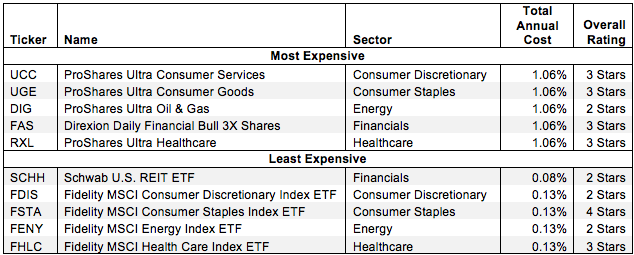

Figure 1 shows the most and least expensive sector ETFs in the US equity universe based on total annual costs. ProShares provides 4 of the most expensive ETFs while Fidelity ETFs are among the cheapest.

Figure 1: 5 Least and Most-Expensive Sector ETFs

Sources: New Constructs, LLC and company filings

ProShares Ultra Consumer Goods (UGE) and Direxion Daily Financial Bull 3X Shares (FAS) are two of the most expensive U.S. equity ETFs I cover, while Fidelity MSCI HealthCare Index ETF (FHLC) and Schwab U.S. REIT ETF (SCHH) are the least expensive. The more expensive UGE and FAS receive my 3-star or Neutral rating, while the cheapest ETFs, SCHH and FHLC, receive my 2-Star rating and 3-Star rating respectively. One of the most expensive ETFs, UGE earns a better rating than three of the cheapest ETFs. Quality holdings can make up for high costs.