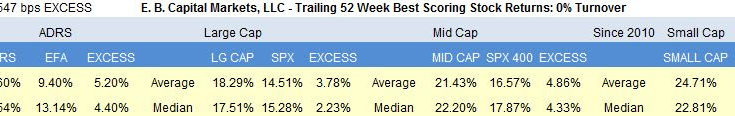

Top scoring weekly returns:Â Buy and Hold 1 Year

It is easy, by diligent study of the past, to foresee what is likely to happen in the future…” Niccolo Machiavelli

Utilities continue to hold onto the top slot in our weekly sector ranking. Basic materials and industrial goods also score above average.

Consumer goods score inline, with mid and small cap consumer scoring relatively better than large cap.

Healthcare, financials, services, and technology score below average. In healthcare, large cap scores above average. In financials, concentrate on mid cap. Services and technology are broadly weak and face seasonal headwinds in summer.

Â

The following chart visualizes score by market cap and sector.

The next chart displays historical four, eight, and 12 week scores. Since 2010, scores have typically bottomed near 50. Historically, a move in the four week moving average above the eight and 12 week averages reflects improving risk/reward. That means current measures continue to reflect de-risking — watch for a crossover for conviction before buying back beta.

UTILITIES

We remain in the strongest seasonal period for utilities. Historically, utilities pause in May before re-exerting in June and July.Â

Â

According to the EIA’s latest long term forecast, U.S. electricity demand is expected to grow 0.9% annually through 2040, representing a cumulative 29% expansion to 4.95 billion kWh. Growth will be led by industrial demand, and capacity expansion will come primarily from natural gas and renewables. Capacity growth through 2016 will average 16 GW/year, with 52% consisting of renewable plants built to take advantage of federal tax incentives. You can access the electricity section of the EIA’s report here.

BASIC MATERIALS

Basics are historically strong performers during the four month period beginning February and ending May. Typically, managers have been rewarded for reducing exposure/normalizing weights into May strength ahead of June, and then overweighting positions in September.Â