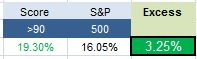

Our top scoring large cap stocks from 1 year ago produced an average 325 bps of excess return to the S&P 500 over the past year. The best performers from a year ago (5/14/2013) are NOC up 57%, EA up 57%, WFT up 57%, MGA up 55%, and SWY up 55%.

- The best large cap sector is utilities.

- The top large cap industry is aerospace/defense

The average large cap score is 59.35, above the four week moving average score of 58.46. The average large cap stock is trading -10% below its 52 week high, 3.11% above its 200 dma, has 3.87 days to cover held short, and is expected to grow EPS by 13.5% next year.

Â

Utilities remain the best scoring sector; however, we’re starting to see other sectors rotate. Industrials, healthcare, basics, and consumer all score above average this week. Financials, technology, and services score below average.