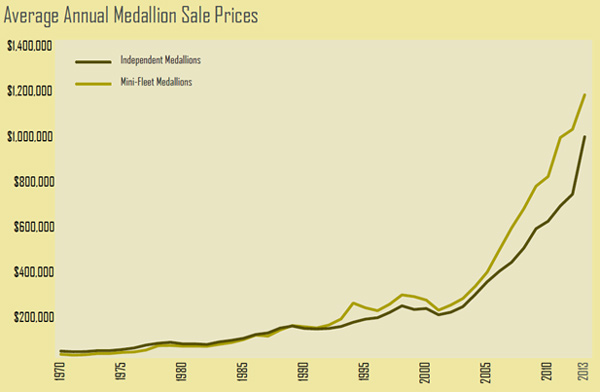

The price of a New York City (NYC) taxi medallion, or a “tinâ€â€™ as the industry has taken to calling them, has risen from $10 when originally issued in the 1930s to well over $1 million today.

That’s about a 15.5% annualized return over the last 80 years, a solid five points better than the S&P 500’s total return (including dividends) over the same period.

And that’s just on face value. Rented to a driver, the return is even higher. According to NYC’s Taxi and Limousine commissioner in a recent Bloomberg interview, the rental rates are around 3 or 4% of face value these days. Those combined returns are enough to make even Warren Buffett blush.

Source:Â 2014 New York City Taxicab Fact Book

Does that mean we’ve all been doing everything wrong with stocks and bonds? Is the taxi medallion really the perfect investment?

In the back of a cab on the way to JFK airport Monday night after a busy day hustling around the city meeting with start-ups and industry partners, I got to chatting about taxi medallions—a subject about which I knew far less than I realized until my wife started asking lots of questions. That quickly evolved into a discussion about the characteristics of a great investment.

Why invest in biotech start-ups? Why risk money on 100-gigabit fiber-optic equipment providers? Why buy venture debt when I could just buy a taxi medallion or two instead?

Her ability to get right to the center of things is one of the reasons I love her… but it drives me up a wall too. So, I got to explaining… making such decisions involves understanding that any investment is only as good or bad as your alternatives.

So how does the medallion do, comparatively? Let’s check a few of the criteria we look for in any investment and see how it stacks up against another of my favorite investments in the current climate of weakening stock returns (the average S&P 500 company was down 9.3% this year as of last week, even though the Index has been buoyed by three or four mega-caps) and less-certain interest rates: venture debt.

The growth capital market, as it’s also called, is just a twist on the classic game of mezzanine financing, where you lend money to businesses stuck between the worlds of smallish bank loans and having enough of a presence to make the public bond or stock markets work. These mid-tier companies are often most in need of working capital and yet have the hardest time getting it, which opens up an opportunity for mezzanine lenders to provide money on very lender-friendly terms (usually on a variable rate basis with equity kickers or convertibility). The problem is, these particular mezzanine lenders focus very specifically on the technology markets, where their detailed understanding of the industry and close connection to venture capital firms provide them with an advantage in finding good quality borrowers.

Both of our prospective investments obviously have a compelling economic value. The medallion is an option on running a constrained business with high built-in demand. Venture debt is a promissory note against the revenues of a fast-growing company, with its equity as collateral. But just how easy would it be for us investors to get involved with either game?

Scarcity: One of the reasons that taxi medallions have proven so valuable is that right at a time when demand escalated as New York’s business economy and tourism draw were both increasing, the supply of taxi medallions has been relatively static. There are only 13,473 medallions authorized in the city, a number that has barely changed since inception eight decades ago, and is actually down from the original 16,900 issued. (Interestingly, the population of NYC itself has edged up only 1.2 million since 1930.)

However, a taxi medallion isn’t like a bar of palladium. Its scarcity isn’t determined by a random collision of celestial bodies a few billion years ago, but is largely controlled by artificial constraints, namely government regulation. The New York state government, which issues the licenses to the city, has had to resist the urge to increase the volume of taxis as a way of raising revenues—remember that it gets a percentage of all taxi fares in the form of taxes—for over 80 years now. Very easily during that time, regulations could have changed to make the medallions far less valuable.

But it hasn’t happened… yet. So far, the supply of taxi medallions has badly trailed demand, and thus prices and yields have remained strong.

In contrast, venture debt is more driven by market forces than the medallion industry. For many years now, deterred by their own cascading series of bubble blunders, banks have been getting progressively less aggressive in their loan portfolios. That means many companies in many industries have had a harder and harder time borrowing money to grow their businesses. As that has happened, the demand for mezzanine lending has steadily grown. A cottage industry that once only served really obscure and risky markets has morphed into dozens of sector-specific companies with a deep understanding of their customer bases.