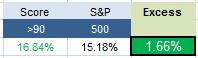

Our top scoring large cap stocks from 1 year ago produced an average 166 bps of excess return to the S&P 500 over the past year. The best performers from a year ago (5/21/2013) are MGA up 55%, MCK up 54%, EOG up 53%, NOC up 51%, and BHI up 47%.

- The top scoring sector is utilities.

- The best scoring industry is railroads.

The average large cap stock score is 56.57, below the four week moving average score of 57.67. The average large cap is trading -10.53% below its 52 week high, 2.23% above its 200 dma, has 3.87 days to cover held short, and is expected to grow EPS by 13.48% next year.

Â

The best scoring sector across our large cap universe is utilities. Healthcare and basic materials also score above average. Consumer goods and industrial goods score in line. Technology, services, and financials score below average.

| LG CAP | Â | Â | Â | 5/22/2014 | 4 Week MA |

| Company Name | Symbol | Sector | INDUSTRY | SCORE | SCORE |

| BEST | Â | Â | Â | Â | Â |

| AbbVie Inc. | ABBV | HEALTHCARE | DRUG MANUFACTURERS | 110 | 91.25 |

| CSX Corp | CSX | SERVICES | RAILROADS | 105 | 83.75 |

| Johnson & Johnson | JNJ | HEALTHCARE | DRUG MANUFACTURERS | 105 | 103.75 |

| Amphenol Corp | APH | TECHNOLOGY | DIVERSIFIED ELECTRONICS | 100 | 102.5 |

| Avalonbay Comm. | AVB | FINANCIALS | REITS | 100 | 100 |

| EnCana Corp | ECA | BASIC MATERIALS | INDEPENDENT OIL & GAS | 100 | 95 |

| Eqt Corp | EQT | UTILITIES | GAS UTILITIES | 100 | 102.5 |

| Green Mtn. Coffee Roasters | GMCR | CONSUMER GOODS | PROCESSED & PACKAGED GOODS | 100 | 96.25 |

| Illumina | ILMN | HEALTHCARE | BIOTECHNOLOGY | 100 | 92.5 |

| Lam Research Corp | LRCX | TECHNOLOGY | SEMICONDUCTOR EQUIPMENT & MATERIALS | 100 | 100 |

| Merck | MRK | HEALTHCARE | DRUG MANUFACTURERS | 100 | 91.25 |

| Shaw Communications Inc | SJR | SERVICES | CATV SYSTEMS | 100 | 81.25 |

| Transdigm Group Inc. | TDG | INDUSTRIAL GOODS | AEROSPACE/DEFENSEÂ PRODUCTS & SERVICES | 100 | 95 |

| Autonation | AN | SERVICES | AUTO DEALERSHIPS | 95 | 90 |

| B P plc | BP | BASIC MATERIALS | MAJOR INTEGRATED OIL AND GAS | 95 | 87.5 |

| Chesapeake Energy | CHK | BASIC MATERIALS | INDEPENDENT OIL & GAS | 95 | 97.5 |

| The Directv Group Inc | DTV | TECHNOLOGY | COMMUNICATION EQUIPMENT | 95 | 96.25 |

| Edison Intl | EIX | UTILITIES | ELECTRIC UTILITIES | 95 | 96.25 |

| Eastman Chemical Co | EMN | BASIC MATERIALS | CHEMICALS- MAJOR DIVERSIFIED | 95 | 86.25 |

| Endo Health Solutions | ENDP | HEALTHCARE | DRUG MANUFACTURERS | 95 | 80 |

| Energizer Hldgs Inc | ENR | INDUSTRIAL GOODS | INDUSTRIAL ELECTRICAL EQUIPMENT | 95 | 91.25 |

| Edwards Lifesciences | EW | HEALTHCARE | MEDICAL APPLIANCES & EQUIPMENT | 95 | 96.25 |

| General Dynamics | GD | INDUSTRIAL GOODS | AEROSPACE/DEFENSEÂ PRODUCTS & SERVICES | 95 | 97.5 |

| Idexx Lab | IDXX | HEALTHCARE | DIAGNOSTIC SUBSTANCES | 95 | 98.75 |

| Kellogg Company | K | CONSUMER GOODS | PROCESSED & PACKAGED GOODS | 95 | 98.75 |

| Lorillard Inc | LO | CONSUMER GOODS | CIGARETTES | 95 | 97.5 |

| O’Reilly Auto | ORLY | SERVICES | AUTO PARTS STORES | 95 | 97.5 |

| P P L Corp | PPL | UTILITIES | ELECTRIC UTILITIES | 95 | 91.25 |

| Constellation Brands | STZ | CONSUMER GOODS | BEVERAGES | 95 | 92.5 |

| Tyson Foods | TSN | CONSUMER GOODS | MEAT PRODUCTS | 95 | 92.5 |

| Time Warner | TWX | SERVICES | ENTERTAINMENT- DIVERSIFIED | 95 | 75 |

| Universal Health | UHS | HEALTHCARE | HOSPITALS | 95 | 76.25 |

| American Int’l Group | AIG | FINANCIALS | PROPERTY & CASUALITY INSURANCE | 90 | 81.25 |

| Alexion Pharma | ALXN | HEALTHCARE | DRUG MANUFACTURERS | 90 | 92.5 |

| Autozone | AZO | SERVICES | AUTO PARTS STORES | 90 | 92.5 |

| Brown Forman Corp | BF.B | CONSUMER GOODS | BEVERAGES | 90 | 90 |

| C H Robinson Worldwide | CHRW | SERVICES | AIR DELIVERY & FREIGHT SERVICES | 90 | 70 |

| Continental Resources | CLR | BASIC MATERIALS | OIL & GAS DRILLING & EXPLORATION | 90 | 87.5 |

| Cummins Inc | CMI | INDUSTRIAL GOODS | DIVERSIFIED MACHINERY | 90 | 92.5 |

| Camden Ppty | CPT | FINANCIALS | REITS | 90 | 93.75 |

| C V S Corp | CVS | SERVICES | DRUG STORES | 90 | 92.5 |

| Walt Disney Company | DIS | SERVICES | ENTERTAINMENT- DIVERSIFIED | 90 | 86.25 |

| Dover Corp | DOV | INDUSTRIAL GOODS | DIVERSIFIED MACHINERY | 90 | 92.5 |

| E O G Resources | EOG | BASIC MATERIALS | INDEPENDENT OIL & GAS | 90 | 92.5 |

| Essex Ppty Trust | ESS | FINANCIALS | REITS | 90 | 95 |

| Entergy Corp New | ETR | UTILITIES | ELECTRIC UTILITIES | 90 | 93.75 |

| Gilead | GILD | HEALTHCARE | BIOTECHNOLOGY | 90 | 85 |

| Halliburton | HAL | BASIC MATERIALS | OIL & GAS EQUIPMENT & SERVICES | 90 | 92.5 |

| Eli Lilly | LLY | HEALTHCARE | DRUG MANUFACTURERS | 90 | 92.5 |

| Public Service Ent. | PEG | UTILITIES | DIVERSIFIED UTILITIES | 90 | 87.5 |

| Public Storage | PSA | FINANCIALS | REITS | 90 | 87.5 |

| Phillips van Heusen | PVH | CONSUMER GOODS | TEXTILES | 90 | 72.5 |

| Reynolds American | RAI | CONSUMER GOODS | CIGARETTES | 90 | 93.75 |

| S L Green | SLG | FINANCIALS | REITS | 90 | 93.75 |

| Salix Pharm | SLXP | HEALTHCARE | DRUGS-GENERIC | 90 | 88.75 |

| Snap On Inc | SNA | INDUSTRIAL GOODS | SMALL TOOLS & ACCESSORIES | 90 | 92.5 |

| A T & T | T | TECHNOLOGY | TELECOM SERVICES – DOMESTIC | 90 | 75 |

| Weatherfold International Inc | WFT | BASIC MATERIALS | OIL & GAS EQUIPMENT & SERVICES | 90 | 93.75 |

| Â | Â | Â | Â | Â | Â |

| WORST | Â | Â | Â | Â | Â |

| Alcatel | ALU | TECHNOLOGY | COMMUNICATION EQUIPMENT | 15 | 22.5 |

| A S M L Holding | ASML | TECHNOLOGY | Â | 15 | 20 |

| Bed Bath & Beyond | BBBY | SERVICES | HOME FURNISHING & FIXTURES | 15 | 16.25 |

| Incyte Corp | INCY | HEALTHCARE | BIOTECHNOLOGY | 15 | 22.5 |

| Leucadia Nat’l | LUK | CONGLOMERATES | CONGLOMERATES | 15 | 16.25 |

| Mattel Inc | MAT | CONSUMER GOODS | TOYS & GAMES | 15 | 21.25 |

| Sei Investments Co | SEIC | FINANCIALS | INVESTMENT BROKERAGE | 15 | 23.75 |

| Sony Corp | SNE | CONSUMER GOODS | ELECTRONIC EQUIPMENT | 15 | 22.5 |

| American Movil | AMX | TECHNOLOGY | WIRELESS COMMUNICATIONS | 20 | 30 |

| Fireeye Inc | FEYE | TECHNOLOGY | APPLICATION SOFTWARE | 20 | 17.5 |

| Gerdau SA | GGB | BASIC MATERIALS | STEEL & IRON | 20 | 20 |

| Nomura Holdings | NMR | FINANCIALS | INVESTMENT BROKERAGE | 20 | 17.5 |

| New York Community | NYCB | FINANCIALS | SAVINGS & LOANS | 20 | 23.75 |

| Dr.Reddy’s Labs | RDY | HEALTHCARE | DRUG MANUFACTURERS | 20 | 50 |

| Red Hat Inc | RHT | TECHNOLOGY | APPLICATION SOFTWARE | 20 | 21.25 |